Start Your Journey

Agriculture Industry: Legal, Licences & Setup Guide

From incorporation to land, safety and sector-specific licences — here’s a complete, compliance-first roadmap for launching an agriculture business in India.

AGRICULTURE INDUSTRY

INTRODUCTION

Agriculture is more than just an industry in India – it's the backbone of the economy and a way of life for millions. Nearly 46% of India’s workforce is engaged in agriculture and allied sectors, contributing around 15–18% to the country’s Gross Value Added. This vast sector covers crop cultivation, horticulture, animal husbandry, fisheries and agroforestry. With increasing demand and export opportunities, agriculture offers fertile ground for new business ventures.

India’s agricultural landscape is highly diverse — from small traditional farms to urban agritech startups using drones and analytics to enhance yields. The government is also supporting the sector through schemes like the Pradhan Mantri Krishi Sinchayi Yojana and the Agriculture Infrastructure Fund, encouraging innovation and infrastructure growth.

Whether you envision a dairy farm in the countryside or a hydroponic greenhouse in the city, opportunities abound. This guide will help you navigate everything — from choosing the right business structure to meeting legal requirements — so you can launch your agribusiness with confidence.

TYPE OF BUSINESS SUITABLE FOR THE AGRICULTURE INDUSTRY

One of the first decisions to make is the legal structure of your agribusiness. In India, you have several options for business entity type, each with its pros and cons. The common structures include:

- Sole Proprietorship: A simple structure where one person owns and runs the business. Ideal for small farms or local produce sales due to minimal compliance. However, the owner has unlimited personal liability and there’s no separation between personal and business assets.

- Partnership Firm: Suitable for joint ventures between farmers or investors. Easy to start with a partnership deed, though registration is optional. Profits and liabilities are shared equally. Partners face unlimited, joint liability, unless upgraded to an LLP.

- Limited Liability Partnership (LLP): Offers limited liability with partnership-style management. Ideal for agri-consultancies or joint ventures. It separates personal assets from business debts and involves moderate compliance. It continues to exist even if partners change.

- Private Limited Company: Best for scalable agribusinesses or startups needing funding. It offers limited liability, separate legal identity and strong credibility. Ideal for export businesses or agri-tech ventures, though it involves higher compliance and mandatory audits.

- One Person Company (OPC): A private company for solo founders offering limited liability and separate legal identity. Requires only one shareholder and a nominee. Ideal for small, owner-driven agri-businesses needing credibility without needing a partner.

- Co-operative Society: Owned by farmer members for collective benefit (e.g. dairy or credit societies). Follows a democratic one-member-one-vote model. Governed by state laws, it’s best for community-based efforts, though slower to form and manage.

- Producer Company: A company for farmer collectives with at least 10 members. Blends cooperative benefits with professional management. Offers limited liability, access to funding, tax benefits and is ideal for collective processing, branding and marketing.

Which structure is best? It truly depends on the scale and nature of your venture. For a small, individually-run farming business, starting as a sole proprietorship or partnership (or registering as an MSME for availing benefits) might suffice initially. As you expand, you can transition into an LLP or Private Limited Company for better liability protection and funding prospects. If the business is going to involve multiple farmers or a community, consider a Producer Company so that the benefits stay with the producers themselves. Many experts advise that if you envision significant growth, a Private Limited Company is the most scalable and investor-friendly structure due to its clear legal identity and limited liability for owners. Ultimately, evaluate factors like ownership control, liability, compliance burden and future capital needs. Choosing the right business type at the outset will make the subsequent steps – registrations, approvals, taxation – align correctly with your goals.

NECESSARY APPROVALS FOR STARTING AN AGRI-BUSINESS IN INDIA

Starting an agriculture business in India involves obtaining a series of approvals and permissions to ensure your venture complies with local and national regulations. These approvals are distinct from licenses in that they often relate to land use, environmental clearances and other permissions you must secure before commencing operations. Below are the key approvals you may need, each explained in a few sentences:

- Business Entity Registration Approval: Formally register your business to gain legal identity. Companies and LLPs need a Certificate of Incorporation from the MCA. Proprietorships or partnerships may use GST or Shop Act registration. This step is crucial for opening bank accounts, entering contracts and applying for further licenses.

- Land Use and Zoning Approvals: Check land zoning laws before starting. Agricultural land use or conversion for commercial activities (like processing units) may need a Land Conversion Permit or NOC. Approval is typically required from the local revenue department or District Commissioner, depending on state laws.

- Construction and Building Approvals: Get building plan approval from the local authority before construction. Structures like warehouses or processing units may also need Fire Safety NOCs. Submit architectural drawings and comply with safety norms. Begin construction only after receiving all required permits to avoid legal action.

- Environmental Clearances and Pollution Control: Processing or manufacturing units need environmental approval. Apply for Consent to Establish (CTE) and Consent to Operate (CTO) from the State Pollution Control Board. Projects with higher environmental impact may need clearance from the central ministry. Eco-friendly farms may be exempt but must confirm eligibility.

- Water Usage and Irrigation Permits: Water-intensive businesses using groundwater, rivers or canals may need permits from CGWA or state authorities. Over-extraction without permission can lead to fines. Even rainwater harvesting may need intimation. Check regional laws to ensure sustainable and legal water usage for your agri-business.

- Local Municipal and Health Department Approvals: Depending on the business type, obtain a Trade License or Shop & Establishment Registration. Health departments may inspect food units, dairy centers or meat processing facilities. Local panchayats may also require NOCs to ensure public health and prevent community disturbances.

Each of these approvals serves a purpose, they ensure the business is set up in a legally permissible location and manner. While it may seem cumbersome to obtain multiple NOCs, doing so protects your business from future disputes or shutdowns. Always start the approval processes early, as governmental clearances can take time due to site inspections and paperwork.

REQUIRED LICENSES FOR AGRICULTURE BUSINESSES

In addition to approvals, you will need to obtain various licenses and registrations specific to the agricultural industry to operate legally. Licenses are formal permissions to carry out certain activities (like selling seeds or food products) and are usually granted by regulatory authorities after verifying that you meet the required standards. Below is a list of key licenses commonly required for agri-businesses in India, each described briefly:

- Food Safety and Standards Authority of India (FSSAI) License/Registration: Mandatory for any food-related activities like processing, packaging, storage or sale. Based on turnover: Basic (₹<12L), State (₹12L–₹20Cr) or Central (>₹20Cr/multi-state). It ensures food safety compliance. Operating without it can lead to penalties or shutdowns.

- Shops and Establishments Act Registration: Required for any workplace with employees — even packhouses or offices. Ensures compliance with labour laws (hours, leaves). Issued by state labour departments or municipalities. Often needed for other registrations or licenses.

- Fertilizer and Pesticide Dealer’s License: Needed to sell fertilizers or crop protection chemicals. Regulated under Fertilizer Control Order and Insecticides Act. Requires eligible staff or training, proper storage and Agriculture Department approval. Selling without this license is illegal.

- Seed Dealer/Nursery License: Mandatory for seed sellers and nurseries. Ensures quality standards and traceability. Issued by the Agriculture Department, may require storage, labelling and records. Selling unlicensed or substandard seeds can result in penalties or license cancellation.

- Livestock-Related Licenses/Permits: For dairy, poultry, fisheries or meat units, animal welfare and disease control permissions may be needed. Often issued by Animal Husbandry or Fisheries Departments. Includes biosecurity, transport or health compliance checks.

- Water and Irrigation Licenses: Large-scale irrigation or borewell use may need CGWA or state approval. Canal usage often requires agreements with irrigation departments. Borewell permits and water harvesting rules may also apply depending on local laws.

- Import Export Code (IEC): A 10-digit number from DGFT needed for all import/export activities. Mandatory to clear customs. Some products also require registration with APEDA or commodity-specific boards for export benefits and compliance.

- APMC Market License: Required to trade in APMC-regulated mandis or buy directly from farmers in many states. Issued by local APMCs. Some states allow simplified licenses for direct purchases. Always verify your state’s mandi laws.

- AGMARK Certification: Voluntary but useful quality certification for food products like ghee, honey or spices. Boosts market credibility. Issued by DMI after testing in government labs. Often required for tenders or quality-sensitive buyers.

- Organic Certification (if applicable): Mandatory to market products as “organic.” Certified under NPOP via APEDA-accredited agencies. Requires multi-year records, inspections and adherence to organic standards. Necessary for exports or selling under “India Organic” branding.

Not all agri-businesses need every license. The requirements vary by activity. A farm selling crops locally may only need APMC registration, while a city-based food processing unit might require FSSAI, Shop Act, GST and trade licenses. Staying compliant keeps your operations legal and builds trust with customers. Displaying licenses like FSSAI or AGMARK enhances credibility. Always track renewal dates using a compliance calendar to avoid penalties. Timely licensing ensures smooth functioning and lets you focus on scaling your business.

WHY SUCH APPROVALS AND LICENSES ARE NEEDED

You might wonder, why go through this cumbersome process of getting approvals and licenses? Can’t you just start farming or trading produce without these bureaucratic hurdles? The reality is that these regulations exist to protect you, your customers and the industry at large. Here are a few key reasons why obtaining the necessary approvals and licenses is absolutely essential:

- Legal Compliance and Avoidance of Penalties: Licenses ensure your business operates legally. Running without required approvals can lead to fines, shutdowns or legal action. Compliance proves your legitimacy and protects you from punitive risks.

- Quality Assurance and Consumer Safety: Licenses like FSSAI or AGMARK enforce quality and safety standards. They protect consumers and farmers from unsafe or fake products, ensuring your offerings meet regulatory benchmarks and build trust.

- Access to Markets and Customers: Certifications help unlock new markets—government tenders, exports and retail chains often require them. Customers prefer licensed sellers, so approvals legitimize your products and boost market credibility.

- Eligibility for Government Schemes and Subsidies: Licensing is essential to access subsidies, grants and loans under government schemes. Registered businesses are prioritized in programs like RKVY and food processing incentives, helping you grow affordably.

- Smooth Operations and Lower Risk: Approvals promote structured operations— encouraging safety, record-keeping and environmental compliance. This reduces risks of accidents, legal issues or pollution problems, helping your business run responsibly and sustainably.

Approvals and licenses are needed shields and enablers – they shield your business from legal trouble and enable you to deliver trustworthy quality to customers while accessing various opportunities. Embracing compliance from day one builds a strong foundation for your agri-business.

HOW LAWFNITY CAN HELP YOU ESTABLISH YOUR AGRICULTURE BUSINESS

Setting up an agriculture business involves navigating a maze of legal requirements and this is where a professional firm like Lawfinity becomes invaluable. Lawfinity is a full-service business consulting firm that provides end-to-end corporate, legal and compliance solutions for entrepreneurs. In simpler terms, Lawfinity acts as a one-stop partner from the moment you decide to start a business, through incorporation, obtaining licenses and staying compliant with ongoing regulations.

Here’s how Lawfinity can assist you in establishing your desired agribusiness:

- Choosing the Right Business Structure: Lawfinity’s legal experts guide you in selecting the ideal business structure—proprietorship, LLP, Pvt Ltd or Producer Company—based on your agri-venture’s needs. They handle incorporation tasks like DIN, MoA, name approval and registration under the Companies Act. Whether you’re an individual or a farmers’ group, Lawfinity ensures smooth setup with accurate documentation and expert advice tailored to agriculture-focused enterprises.

- Regulatory Approvals and Licensing: Lawfinity identifies and obtains all necessary licenses for your agri-business—FSSAI, fertilizer, seed, IEC, Shop Act and more. Their team handles end-to-end paperwork and filing, saving you time and avoiding government-runaround. Whether launching a spice export unit or a seed retail shop, they secure every approval in the correct order, ensuring full compliance with minimal hassle.

- Legal Compliance and Advisory: Lawfinity offers ongoing compliance support—managing filings, renewals, tax reports and legal changes. They maintain your records, track deadlines and draft/review contracts like supply agreements or land leases. This ensures your agri-business stays legally sound, letting you focus on operations while they handle the paperwork and regulatory complexity.

- Strategic Advisory and Growth Support: As your business grows, Lawfinity provides strategic guidance on funding, investor compliance, due diligence and government scheme applications. Facing legal issues like land disputes or pollution notices? They deploy domain experts to resolve them. With legal, tax and finance professionals on board, they support every phase of your agricultural venture’s growth.

Lawfinity brings clarity and peace of mind to entrepreneurs navigating the complex legal landscape of agri-business. They simplify paperwork, regulatory hurdles and compliance tasks so you can focus on what you do best—growing your business. Whether you're a horticulturist or a food processor, Lawfinity ensures that your venture is built on a strong legal foundation from the start.

From company incorporation to obtaining licenses and managing ongoing compliance, Lawfinity handles it all. Their expert team stays updated with laws and deadlines, offering end-to-end support tailored to agriculture ventures. By partnering with Lawfinity, you eliminate the fear of missing legal steps and gain the confidence to move forward. Their goal is simple: to let you grow your business, while they manage the red tape.

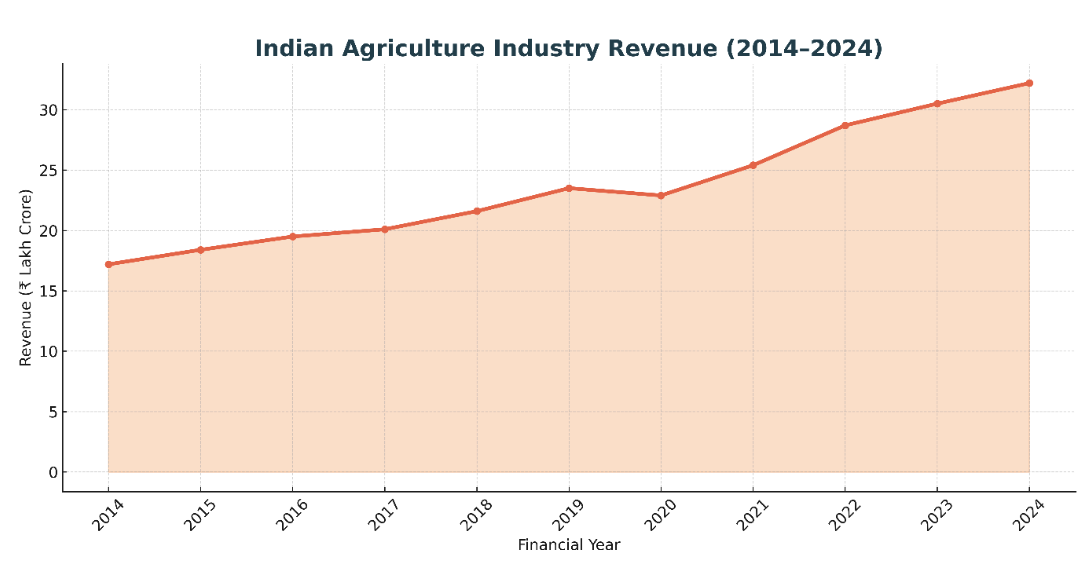

INDIAN AGRICULTURE INDUSTRY REVENUE (2014–2024)

Source: Ministry of Agriculture & Farmers Welfare (GoI) Annual Reports, CRISIL Industry Research 2023, India Brand Equity Foundation (IBEF), NITI Aayog agricultural economy whitepapers, RBI Handbook of Statistics on Indian Economy, Statista & Industry research publications (2023–2024)

AUTHOR’S PERSPECTIVE: SOIL TO SUPPLY CHAIN – A DECADE OF GROWTH

The Past: Growth on Ground (2014–2020)

Between FY 2014–15 and FY 2019–20, India’s agriculture sector witnessed consistent growth from ₹17.2 lakh crore to ₹23.5 lakh crore. This was fueled by a mix of government policy (PM-KISAN, e-NAM), rising institutional credit and productivity gains through mechanization. Despite monsoon variability, the sector stayed resilient thanks to irrigation expansion and hybrid seeds.

The green shoots of digital intervention also began — with early-stage agri-startups, warehousing reforms and FPOs (Farmer Producer Organizations) enabling better price realization for farmers.

The Present: Pandemic Setback, Then a Resilient Bounce

In FY 2020–21, revenue dipped slightly to ₹22.9 lakh crore due to COVID-19 restrictions on supply chains, mandis and migrant labour availability. Yet, agriculture was the only sector to record positive growth that year, cushioning India’s GDP.

Post-2021, the sector recovered rapidly. Strong MSP procurement, record foodgrain production and a rise in exports of rice, spices and pulses pushed revenues to ₹32.2 lakh crore by FY 2023–24. Agri-tech platforms, farm insurance schemes and DBT (Direct Benefit Transfer) programs also played a pivotal role in modernization and efficiency.

The Future: A Digital and Climate-Smart Agri Economy

India’s agriculture sector is poised for a new phase of transformation. The projected CAGR of 6–7% is driven by:

- Wider use of precision farming and AI-led agri-tech

- Climate-resilient cropping and smart irrigation

- Expansion of agri exports (millets organics, processed foods)

- Greater private investment in food processing and warehousing

- A shift from volume to value — with focus on horticulture, dairy, aquaculture and allied activities

Government focus on FPOs, rural logistics infrastructure and digital soil health cards will deepen the reach and performance of farming enterprises across Bharat.

CONCLUSION: FROM FARMS TO FUTURES

From my viewpoint, India’s agriculture industry is no longer just about sowing seeds in rural fields — it’s rapidly transforming into a modern, tech-driven and globally competitive sector. With increasing adoption of agri-tech innovations, better access to markets and rising investments from both public and private sectors, agriculture is gaining new momentum.

Sure, traditional issues like overdependence on monsoons, small landholdings and outdated practices are still real challenges — but what’s exciting is the way new solutions are coming in. From drone monitoring and AI-driven crop planning to digital supply chains and export-focused farming, the sector is moving beyond just subsistence to become a serious economic force.

The next decade could well be a turning point — not just for improving farmer incomes, but for making agriculture more sustainable, climate-resilient and inclusive. More women, youth and startups are stepping in, creating a fresh energy that was missing before.

Agriculture isn't just India's oldest occupation — it’s shaping up to be its regenerative and future-proof growth engine. And this time, it’s rooted in both tradition and transformation.

Frequently Asked Questions

Because every great business starts with the right answers.

From organic farming and livestock to agri-processing, urban farming or agri-tech startups, India’s agriculture sector offers diverse opportunities depending on your skills, location and available resources.

You can start as a sole proprietor, but forming a company (like Pvt Ltd or LLP) helps scale, attracts funding and eases regulatory access. Start small, upgrade later.

Land purchase rules vary by state; non-farmers may face restrictions. Leasing is a safer option. Land use conversion is essential for non-agricultural activities on farm land.

Common licenses include FSSAI, GST, Seed/Fertilizer license and Shop Act registration. Specific needs depend on your business type. Exports need IEC, APEDA; processing often requires additional compliance.

FSSAI is typically required if you process, package or brand food. Small direct sellers may be exempt, but formal businesses—even home-based—should register for legal and customer trust.

Central/state schemes like RKVY, PM-FME, AIF, NABARD loans and Startup India offer grants, subsidies and loans. Choose based on your business type, location and investment size.

FPCs are co-ops for farmers, enabling collective input buying, processing and selling. Ideal for group ventures; individuals should prefer sole proprietorships, LLPs or Pvt Ltd companies.

Individual farming income is tax-exempt. However, companies or value-added businesses pay tax on non-agricultural profits. Consult a CA to structure operations for tax efficiency.

You can DIY some registrations, but legal consultants save time, ensure compliance and prevent costly errors. Professionals are especially useful for complex filings or growth-stage planning.