Start Your Journey

Building India’s Future – The Construction Industry

From roads and housing to mega infrastructure, this sector is the backbone of India’s growth story — but navigating it requires as much legal precision as engineering expertise.

INTRODUCTION

The construction industry is one of the key drivers of India’s economic growth. It contributes nearly 9% to India’s GDP and provides employment to over 51 million people. From housing and infrastructure to commercial real estate and highways, construction plays a crucial role in nation-building. As India moves towards urbanisation, smart cities and large-scale infrastructure development, the demand for construction businesses is rapidly growing.

However, starting a construction business in India is not as simple as renting machines and hiring workers. It involves legal structuring, obtaining various licenses, approvals and compliance with several local and national laws. Whether you are aiming to build roads, bridges, residential societies or government infrastructure—legal clarity is vital to avoid disruptions and ensure sustainability.

In this blog, we will give you a comprehensive understanding of how to start a construction business in India—from business incorporation to the licenses and approvals required by law. Let’s build the foundation step by step.

TYPE OF BUSINESS STRUCTURE BEST FOR A CONSTRUCTION COMPANY

Choosing the right business structure is the first step before you start operations in the construction sector. Your structure affects your liability, taxation, funding potential and compliance obligations.

- Private Limited Company (Most Preferred): A private limited company is the most suitable structure for a construction business. It offers limited liability protection to shareholders, allows for easy funding and gives your company credibility when bidding for government or private projects. It’s ideal for medium to large-scale operations.

- Limited Liability Partnership (LLP): LLP is suitable for small to medium builders or contractors who want the flexibility of a partnership with the protection of limited liability. However, LLPs may face restrictions when applying for tenders or loans from certain banks.

- Sole Proprietorship / Partnership: These are easier to start and operate at a small scale but don’t offer limited liability protection. If you are planning to operate locally as a labour contractor or small builder, this structure may suffice. However, this may not be ideal for scaling or dealing with government contracts.

Which structure is best? If your goal is to bid on government projects, work with real estate developers or expand into large infrastructure work, a Private Limited Company is the best choice. It adds professional weight to your business and makes the registration and compliance process smoother with authorities like CPWD, PWD, RERA, NHAI and others.

NECESSARY APPROVALS REQUIRED FOR CONSTRUCTION BUSINESS IN INDIA

Different types of approvals are required depending on the scale and nature of your construction projects. Here's a list of standard approvals most businesses need:

- Building Plan Approval: Before construction starts, you must get your building layout approved by the municipal or development authority. The plan must follow local zoning laws, floor space index (FSI), fire safety norms and building by-laws. Without this sanction, your construction can be declared illegal and subject to penalties or demolition.

- Environmental Clearance (EC): Mandatory for large construction projects (typically over 20,000 sq. meters), EC ensures that your project doesn't harm the environment. The SEIAA assesses environmental impact factors like air quality, water usage and green area. Without EC, such projects can't legally begin or secure other required approvals from urban development bodies.

- Consent to Establish (CTE) from Pollution Control Board: Issued by the State Pollution Control Board, CTE is required before starting construction that may cause air, noise or water pollution. It evaluates your project’s impact on the environment and checks waste management practices. It’s crucial for mechanised or large-scale construction under the Air and Water (Prevention) Acts.

- Fire Safety NOC: This is needed for buildings over a specified height (usually 15 meters). The Fire Department assesses fire safety measures like exits, alarms, extinguishers, sprinklers and water tanks. The NOC certifies that your building design complies with fire prevention codes, which is mandatory for construction and occupancy approval later on.

- Airport Authority and Defence Clearance: If your site is close to an airport or defense zone, you must obtain clearance from AAI or the Ministry of Defence. They ensure your structure doesn’t obstruct air navigation or violate security perimeters. This is crucial to avoid future construction bans, fines or demolition in sensitive areas.

LICENSES REQUIRED FOR RUNNING A CONSTRUCTION BUSINESS

Once you have got the approvals, several licenses are mandatory to legally operate a construction company in India.

- Contractor License from PWD/CPWD: To bid on public construction contracts, builders must register with PWD or CPWD as Class I, II or III contractors. Your classification depends on technical expertise, financial capacity and experience. Without this license, you cannot legally undertake government infrastructure projects or qualify for public sector tenders.

- GST Registration: Construction businesses must register for GST under Section 22 of the CGST Act if their annual turnover exceeds ₹20 lakh (or ₹10 lakh in special category states). GST registration is mandatory for legal invoicing, claiming input tax credit and executing contracts with clients, especially in commercial or government projects.

- Labour License under the CLRA Act: If you employ 20 or more workers, a Labour License is mandatory under the Contract Labour (Regulation and Abolition) Act, 1970. It protects workers’ rights and ensures compliance with labour welfare norms like safety, wages and working hours. Operating without this license can lead to legal penalties or work stoppage.

- PF and ESI Registration: Employers with over 20 workers must register for PF (Provident Fund) and those with 10 or more must register for ESI (Employee State Insurance). These schemes provide retirement savings and health benefits for employees. Registration is mandatory under Indian labour laws to ensure social security and avoid hefty non-compliance fines.

- Professional Tax Registration: In states like Maharashtra, Karnataka and West Bengal, companies employing salaried professionals or technical staff must register for Professional Tax. It’s a small monthly tax deducted from employee salaries. Non-registration can lead to penalties. Rules vary by state, so this is essential for companies with offices in multiple regions.

- Trade License: Issued by your local municipal authority, a Trade License is mandatory for operating any business activity within city limits. For construction firms, it permits legal functioning of your site office or headquarters. This license ensures your operations meet safety, zoning and local regulatory norms enforced by urban local bodies.

WHY THESE LICENSES AND APPROVALS ARE MANDATORY

These regulations might look like a mountain of paperwork, but they are absolutely essential. Here’s why:

- Legal Validity: Without mandatory licenses, authorities can stop your construction work or label the project illegal. In worst cases, built structures may face demolition orders, leading to heavy losses, legal troubles and delays in completion or occupation certification.

- Safety and Environment: Approvals like EC, Fire NOC and CTE ensure your project follows safety norms and environmental regulations. This helps avoid accidents, pollution violations or lawsuits, while also protecting workers, future occupants and the surrounding ecosystem from harm.

- Eligibility for Contracts: You can’t bid for government or large private construction contracts unless registered with authorities like PWD, CPWD or RERA. Licensing verifies your capability and legal standing, making you eligible for high-value tenders and long-term infrastructure projects.

- Bank Loans and Investment: Banks and NBFCs won’t approve loans, overdrafts or project finance unless your construction company is legally registered and compliant. Proper documentation reassures lenders about your legitimacy, risk profile and project viability, encouraging credit and investor trust.

- Reputation and Growth: Clients, partners and authorities trust companies that follow legal norms. Having licenses and approvals enhances your professional image, opens doors to collaborations and makes expansion easier—whether scaling to new cities or partnering on joint ventures.

Ignoring these can result in heavy penalties, blacklisting or even imprisonment in some cases. Compliance is not a choice—it’s a necessity in the construction world.

HOW LAWFINTY HELPS YOU SET UP A COMPLIANT CONSTRUCTION BUSINESS

Setting up a construction company isn’t just about paperwork—it’s about building something with long-term sustainability. At Lawfinity, we don’t just help you incorporate a company—we help you build a compliant and future-ready business.

Here’s how we assist you:

- Business Registration: We guide you in selecting the best legal structure—Private Limited, LLP or Partnership—based on your needs. Our team handles PAN/TAN applications, name approvals and Registrar of Companies (ROC) filings for a smooth and compliant setup process.

- Tender Registration: We help contractors register with state and central authorities like PWD, CPWD and MSME. This ensures you are eligible to bid on government infrastructure and civil contracts, increasing your business opportunities and establishing you as a credible contractor.

- License Approvals: From GST registration to labour licenses and PF/ESI onboarding, we manage the full documentation and application process. Our experts ensure you are compliant with law and operating operations without hiccups, and with fewer rejections.

- Environmental and Fire NOC: Our consultants manage key approvals like Consent to Establish (CTE), Consent to Operate (CTO), Environmental Clearance (EC) and Fire NOC. We coordinate with Pollution Control Boards and Fire Departments to ensure your site is compliant before construction.

- Post-Incorporation Compliance: We help maintain your company’s legal health with timely ROC filings, labour documentation, safety compliance audits and drafting of standard agreements. Post-launch, we ensure you are always inspection-ready and fully compliant with business and construction laws.

- Pan-India Support: With expert teams across states including Maharashtra, Delhi NCR, Karnataka, Bihar and more—we offer localized legal, environmental and construction compliance support to contractors, developers and builders looking to operate or expand across India.

We believe in making legal compliance stress-free, cost-effective and fast—so you can focus on building the next skyline.

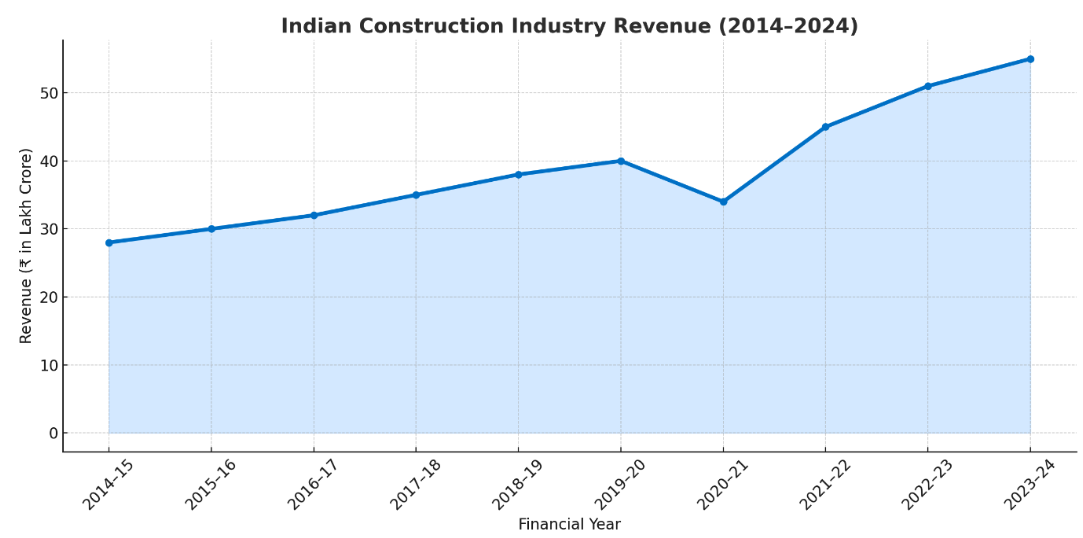

INDIAN CONSTRUCTION INDUSTRY REVENUE (2014–2024)

Source: IBEF Reports, CRISIL Infrastructure & Construction Outlook, FICCI–EY Construction and Urban Development Reports, Ministry of Statistics and Programme Implementation (MoSPI) and Economic Survey of India 2023

From FY 2014–15 to FY 2019–20, the Indian construction industry experienced a steady and robust expansion, growing from ₹28 lakh crore to ₹40 lakh crore. This upward trend was powered by increasing investments in infrastructure, affordable housing, urban development and commercial real estate.

The graph shows a notable dip in FY 2020–21, when revenues fell to ₹34 lakh crore, largely due to COVID-related lockdowns, supply chain disruptions and mass labor migration — all of which halted thousands of construction projects nationwide.

However, the industry rebounded sharply in FY 2021–22, climbing to ₹45 lakh crore, as the government ramped up public infrastructure spending under the National Infrastructure Pipeline (NIP), Gati Shakti Mission and urban housing schemes like PMAY. Private real estate also resurged with pent-up demand post-pandemic.

In FY 2022–23 and FY 2023–24, the sector regained momentum, reaching ₹51 lakh crore and then ₹55 lakh crore, respectively. This growth reflects faster project clearances, digitization under RERA and stronger private-public investment cycles.

Overall, the graph reflects an industry that is resilient, diversifying and fundamentally aligned with India’s economic development agenda.

AUTHOR’S OPINION: BUILDING INDIA — LAYER BY LAYER

The Past: Foundations of Growth (2014–2020)

Between FY 2014–15 and FY 2019–20, the Indian construction industry saw consistent double-digit growth, increasing from ₹28 lakh crore to ₹40 lakh crore. This momentum was driven by a nationwide infrastructure push — highways, metro rail, smart cities and affordable housing all gained traction. Government-backed initiatives like AMRUT, Bharatmala, PMAY-U and Smart Cities Missioncreated a solid demand pipeline for contractors, developers and real estate investors alike.

Private investment in malls, office parks and gated communities also boomed in metro cities. India’s urbanization curve was finally catching up with its demographic growth. The construction workforce — both organized and informal — expanded rapidly, making it the second-largest employment generator after agriculture.

Yet, challenges persisted: bureaucratic hurdles, land acquisition delays and funding bottlenecks often stretched project timelines.

The Present: Shock Absorption and Structural Revival

FY 2020–21 brought the industry’s biggest test. COVID-19 lockdowns paralyzed labor mobility, disrupted supply chains and froze real estate transactions. Revenue dropped sharply to ₹34 lakh crore — a major blow after five years of gains.

But the sector’s bounce-back was both fast and impressive. By FY 2021–22, with increased government capital expenditure, infra budgets and liquidity in real estate, revenues jumped to ₹45 lakh crore. The National Infrastructure Pipeline (NIP) and PM Gati Shakti became the new engines of growth.

The adoption of digital project management, prefabrication, e-approvals via RERAand return of migrant labor helped stabilize momentum. Real estate, once flat, turned bullish again — especially in Tier 2 and Tier 3 cities where residential demand soared.

The Future: Smart, Sustainable and Strategic

Looking ahead, the construction industry is poised to reach ₹75 lakh crore by FY 2026–27, with a CAGR of 9–10%. Key drivers will include:

- Green building mandates and LEED certifications across commercial and institutional projects

- Affordable rental housing under the Urban Rental Housing Scheme

- Private equity inflows into warehousing, co-living and logistics parks

- Massive spending under urban redevelopment, transport corridors and SEZ modernization

Digital twins, AI-driven planning, BIM (Building Information Modelling) and smart contracts are likely to redefine how India builds. There’s also a growing focus onESG compliance, net-zero carbon footprint and construction waste recycling — aligning growth with sustainability.

CONCLUSION: INDIA’S CONSTRUCTION INDUSTRY — FROM FOUNDATIONS TO FUTURE FRONTIERS

From my perspective, the Indian construction industry has evolved from being a traditional brick-and-mortar sector into a strategic pillar of India’s economic transformation. It is no longer just about constructing buildings or laying roads it is aboutengineering inclusive growth, urban transformation and infrastructure-led development.

The sector’s resilient journey from ₹28 lakh crore in FY 2014–15 to ₹55 lakh crore in FY 2023–24, even in the face of a global pandemic, stands as a testament to itseconomic robustness, policy responsiveness and recovery capability. It has not only provided millions of jobs across the formal and informal workforce but also stimulated allied sectors like steel, cement, real estate, IT services and logistics.

Today, construction is not just physical—it’s smart, sustainable and strategic. With the integration of technologies like Building Information Modelling (BIM),AI in project management,IoT-enabled smart infrastructure and digital procurement systems, India’s construction future is being designed in code as much as in concrete.

Government reforms like PM Gati Shakti, RERA, single-window clearance systems and ease-of-doing-business policieshave accelerated the shift toward transparency and investor confidence. At the same time, India’s push for climate-resilient green buildings, mass transit systems and net-zero emission targetsis guiding the construction sector toward environmentally responsible growth.

Whether it’s the bullet train corridor in Gujarat, the international airport in Noidaor urban redevelopment in Varanasi, every beam, brick and bolt today is aligned with anational narrative of progress.

In a country striving for a $5 trillion economy, the construction industry is not just a contributor— it is an architect of ambition. It builds more than just infrastructure — it buildsconfidence, capacity and a collective future.

This is not merely industrial expansion —This is nation-building in its most tangible form.

Frequently Asked Questions

Because every great business starts with the right answers.

There’s no legal minimum capital, but ideally ₹5–10 lakh is needed to cover machinery, labor wages and initial compliance costs like registration, insurance and licenses to get started properly.

Yes, you can begin as a sole proprietor, but forming a company like a Private Limited or LLP is better for scaling, securing tenders, attracting investors and limiting personal liability.

It usually takes 45–90 days to obtain all required licenses, NOCs and registrations. Timelines vary depending on project location, local authority responsiveness and the type of construction activity planned.

A single GST registration is enough for one state. If you execute projects in multiple states, separate GST registrations are required for each state under the CGST and SGST framework.

Operating without environmental clearance can lead to fines up to ₹1 lakh per day. Authorities may halt construction, revoke permissions or even demolish unauthorized structures under the Environment Protection Act.

Yes. RERA registration is mandatory if your project exceeds 500 sq. meters or includes more than 8 apartments. It ensures buyer protection, project transparency and developer accountability under the law.

To apply for PWD tenders, you typically need a valid contractor license, GST certificate, PAN, audited financial statements and a bank solvency certificate to demonstrate financial and technical capability.

Yes, 100% foreign direct investment (FDI) is permitted in construction development projects under the automatic route. However, FDI is not allowed in pure real estate brokerage or agricultural land transactions.

Yes. Construction laws vary by state and sector. Hiring a legal consultant ensures all licenses, NOCs, labor compliances and environment approvals are handled correctly, preventing future penalties or delays.