Start Your Journey

Start Your Cosmetic Brand with Legal Confidence

Licensing, compliance and approvals handled by Lawfinity’s cosmetic law experts.

INTRODUCTION

India’s cosmetic industry is growing really fast and honestly, it’s opening up a lot of opportunities for new businesses. The beauty and personal care market is expected to cross USD 20 billion by 2025, which is quite huge. But starting a cosmetic business isn’t just about cool packaging or a catchy brand name—you also gotta follow some important laws.

As per the Drugs and Cosmetics Act, 1940 and the new Cosmetic Rules, 2020, anything that’s used for cleaning, beautifying or changing how someone looks—like lotions, perfumes, soaps, makeup—is called a cosmetic. And to make or sell such products, legal approvals are must.

In this guide, I will walk you through everything—like how to choose the right business type, register your company and what licenses you need to get. Doesn’t matter if you are making handmade soaps at home or planning to start a full-on manufacturing unit, knowing the legal stuff from the beginning really helps.

Also, following the rules not only keeps you out of trouble, but it builds trust with your customers too. So yeah, let’s start with picking the right business structure for your cosmetic venture.

TYPE OF BUSINESS STRUCTURE FOR A COSMETIC BUSINESS

One of the first steps is to decide on a suitable legal structure for your cosmetic business. In India, you have several options including sole proprietorship, partnership firm, Limited Liability Partnership (LLP), One Person Company (OPC) or a Private Limited Company. The choice depends on your ownership pattern, investment plans and growth outlook:

- Sole Proprietorship: A one-person business, easy to start with minimal paperwork. Best for small setups, but the owner is fully liable for any losses or legal issues, which can be risky in this industry.

- Partnership or LLP: Good if you have co-founders. LLP is better than a regular partnership as it gives limited liability, more trust and flexibility to add partners. It’s a safer choice for growing cosmetic businesses.

- Private Limited Company: Ideal if you plan to scale, raise funds or export. It offers limited liability, has higher compliance, but helps in getting licenses, building brand trust and protecting trademarks. Preferred for serious cosmetic ventures.

In summary, for a modest home-grown cosmetic line you may start as a sole proprietor, but if you envision significant growth or outside funding, forming a private limited company is advisable. Ensure whichever structure you choose is properly registered and documented – this will be the foundation for all further approvals and licenses.

NECESSARY APPROVALS TO START A COSMETIC BUSINESS

Before you can dive into producing or selling cosmetics, there are several approvals and registrations you must obtain to legally establish your business. Each of these ensures that your business operations start on the right side of the law from day one. Below are the key approvals required:

- Business Incorporation: Start by registering your business. Sole proprietors need local or MSME registration, while LLPs or companies must register with MCA. This gives your business legal identity and helps you get licenses, PAN, TAN, open bank accounts and raise funds.

- GST Registration: If you sell cosmetics, especially online or outside your state, GST registration is a must. Even small businesses benefit by claiming input tax credit. Cosmetics attract 18% GST and regular GST return filing is mandatory once you register.

- Local Trade License: To open a store or factory, you’ll likely need a trade license from the local municipal body. It ensures your shop or unit meets hygiene and safety rules. Usually, officials visit the premises before granting approval for operations.

- Shop and Establishment Registration: If you run a store, office or factory and hire staff, you must register under the Shops and Establishments Act. It covers employee rights like work hours and wages. Even a home office needs it once you hire people.

- Pollution Control Board NOC: If your factory uses chemicals or generates waste, get clearance from your State Pollution Control Board. First, apply for Consent to Establish, then Consent to Operate. You must show how you’ll manage waste and avoid harming the environment.

- Fire Safety NOC: For factories or warehouses, a Fire NOC is often needed. You must install fire extinguishers, alarms and follow safety rules. The fire department will inspect your setup before approving. It’s essential, especially if you are storing flammable cosmetic ingredients.

- Import-Export Code (IEC): If you want to import cosmetic ingredients or export products, get an IEC from DGFT. It’s a one-time, 10-digit code needed for customs clearance. Even online brands should get it early if international sales are part of your plan.

- Trademark Registration: Your brand name matters in cosmetics. Apply for a trademark early to protect it. You can use “TM” once you file the application. This avoids future disputes and gives your brand legal backing, especially if it becomes successful later.

(Each of the above approvals should be obtained in the initial stages of setting up the business. In some cases, you can pursue them in parallel. For example, you can apply for GST and IEC soon after incorporating your company. Ensuring these basic registrations are in place will make the licensing process smoother, since authorities will ask for company incorporation certificates, tax IDs, etc., during license applications.)

REQUIRED LICENSES FOR THE COSMETIC INDUSTRY

Once your business entity is set up and preliminary approvals are in hand, the next major step is obtaining the specific licenses required to make and sell cosmetic products legally in India. The Drugs and Cosmetics Act, 1940 (as updated by the Cosmetic Rules, 2020) lays down a strict regulatory regime for cosmetics to ensure public safety. Here are the key licenses you will need, each explained in 3-4 sentences:

- Cosmetic Manufacturing License: If you are making cosmetics for sale, you need a manufacturing license from your State Drug Control office. They’ll inspect your unit for hygiene, equipment and qualified staff. Without this license, manufacturing is illegal and may lead to heavy penalties.

- Loan License (Contract Manufacturing): Don’t have your own factory? You can apply for a loan license to legally use another manufacturer’s setup. It’s perfect for startups using third-party units. The license allows your brand to be made at their approved facility under legal terms.

- Import Registration for Cosmetics: Want to import finished cosmetics into India? Get each product registered with CDSCO. You’ll need to submit safety data, artwork, ingredient lists and more. Without this registration, customs will block the product and penalties may apply. It’s product-specific.

- Cosmetic Sales License (If Required): Retail sale of cosmetics usually doesn’t need a special license, but some states ask wholesalers to get a sales license. It’s best to check with your state authority to avoid issues. You might need it for bulk selling or distribution.

- Factory License (Factories Act): If you employ 10+ workers (with power) or 20+ (without), you’ll need a Factory License under the Factories Act. This ensures safe working conditions. It’s separate from cosmetic laws but very important for worker safety in manufacturing environments.

(In addition to the above, if you set up your own laboratory for testing cosmetics or raw materials, that lab would need approval – a license on Form 37 (granted on Form COS-3 in new rules) allows you to carry out testing on cosmetics. Most startups, however, use third-party NABL-accredited labs for testing and thus wouldn’t need their own lab license. Also, remember to renew or retain your licenses as required – e.g., manufacturing licenses now remain valid perpetually if you pay the retention fee every 5 years.)

WHY APPROVALS AND LICENSES ARE NEEDED

You might wonder why there is such an extensive list of approvals and licenses to start a cosmetics business. These requirements are in place to ensure that the cosmetics sold to the public are safe and manufactured in quality-controlled environments. Here are the key reasons why these approvals and licenses are necessary:

- Legal Compliance & Risk Avoidance: Skipping licenses can land you in legal trouble—fines, shutdowns or worse, jail. Getting approvals early saves you from future stress. It’s always smarter to follow the rules than deal with legal action or sudden business disruption.

- Consumer Safety: People apply cosmetics on skin and hair, so bad quality can hurt them. Licenses make sure you follow hygiene, safety and quality checks. Fire and pollution clearances also protect your workers and nearby areas from harm.

- Product Quality and Standards: Licenses force you to meet Indian quality norms—no banned chemicals, proper testing, clear labels. This helps you make safe, high-standard products. Following BIS or CDSCO rules ensures your cosmetics are clean, trusted and globally competitive.

- Consumer Trust and Market Credibility: Being a licensed business builds customer trust. Buyers prefer brands that follow the law and safety norms. Retailers and online sites too prefer registered brands. It’s not just legal—licenses help your brand look serious and reliable.

- Access to Markets and Growth Opportunities: With all licenses, you can sell across India or even globally. IEC helps in exports; GST allows nationwide sales. Investors, big stores and government schemes all look for compliant companies. Licenses open many doors for your growth.

In essence, these approvals and licenses are not mere red tape – they form a compliance shield that guards your business and customers. Navigating the process might seem complex, but it ensures your cosmetic business can operate sustainably, ethically and profitably in the long run.

HOW LAWFINITY CAN HELP YOU START YOUR COSMETIC BUSINESS

Starting a cosmetic brand in India includes much more than just having beautiful packaging or getting the formulation right. It is a very meticulously compliance-based activity as it not only requires compliance to laws, rules and regulations but calls for a very thorough understanding of applicable guidelines for the Drugs and Cosmetics Act, 1940 and Cosmetics Rules, 2020. At Lawfinity we strive to assist cosmetic entrepreneurs to explore and work in this labyrinth world of cosmetics through complete legal and documentation assistance.

Our Team Makes your Work Easier – As a new e-commerce beauty brand, you’re sourcing your products from a contract manufacturer, you are an importer of foreign ready-made cosmetics or you are a private label entrepreneur, our expert team ensures your business will be 100% compliant with Indian cosmetic regulations from the start of your business to the product launch.

Our Comprehensive Services Include:

- Business Incorporation and Legal Structuring: We help you choose the most suitable structure whether LLP or Private Limited Company, based on your business model and future goals. We handle company registration, PAN/TAN allotment and ensure MCA compliance to legally establish your cosmetic venture.

- CDSCO License Application (Manufacturing/Import): We prepare and file license applications for Form COS-8 (Manufacturing) and Form COS-2 (Import) through the CDSCO SUGAM portal. Our team ensures accurate documentation, right from PIF (Product Information File) to safety certifications and technical dossiers.

- Infrastructure and Premises Compliance Guidance: Setting up a compliant facility is crucial. We provide detailed advisory on minimum space requirements, hygiene norms, raw material handling, HVAC systems and layout design to meet CDSCO inspection standards.

- Loan License and Third-Party Manufacturing Setup: Want to launch your cosmetic brand without owning a factory? We help you secure a loan license and facilitate tie-ups with licensed third-party manufacturers, enabling you to sell under your own brand name legally.

- Technical Documentation and Label Vetting: Our specialists handle preparation of PIFs, test reports, ingredient safety data and batch records. We also review your product labels to ensure they meet Indian legal standards—such as declarations on net weight, batch number, MRP, expiry and warnings.

- GST & FSSAI Registration: We handle your Goods and Services Tax (GST) registration and, where applicable, FSSAI licensing for products classified as nutraceuticals or cosmeceuticals, enabling you to operate smoothly in the tax and health compliance ecosystem.

- Contract Drafting and Legal Documentation: From vendor agreements, non-disclosure agreements (NDAs), distribution MoUs, to supply chain contracts, we draft legally sound documents that protect your brand and streamline business partnerships.

- Regulatory Coordination and Representation: We interact with CDSCO, State Licensing Authorities and local drug inspectors on your behalf. Our experts manage inspections, queries, follow-ups and renewals so that you can focus on branding and growth.

Whether you are building a luxury skincare label, a gender-neutral cosmetics line or a value-for-money personal care brand, Lawfinity ensures your legal base is strong, your licenses are in place and your business is protected from day one.

Ready to start your compliant cosmetic journey?

Visit www.lawfinity.in or contact us today for expert guidance. Let Lawfinity be your strategic legal partner in shaping a bold, beautiful and legally compliant cosmetic brand in India.

A DECADE OF BEAUTY – INDIA’S COSMETICS & PERSONAL CARE INDUSTRY

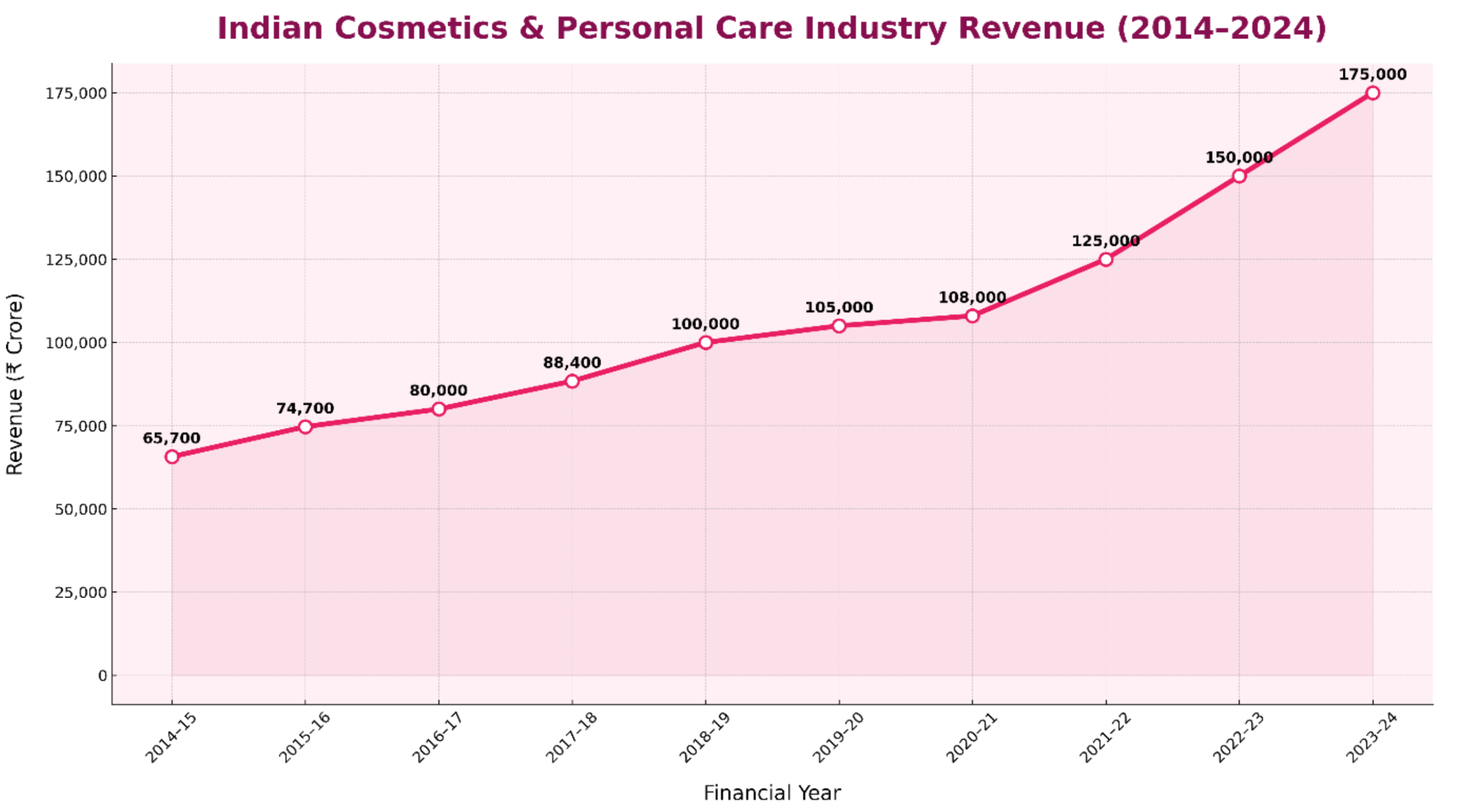

Source: Euromonitor (via Quartz/PTI), Euromonitor Digest (Indian BPC market analysis), IBHA (industry association) reports, RedSeer/Nykaa report (via Economic Times) and Expert analyses of COVID-19 impact

- 2014–15 to 2018–19

The industry showed consistent growth, moving from ₹65,700 crore to ₹1,00,000 crore. This phase marked the expansion of beauty awareness, especially in urban India.

- 2019–20 to 2020–21

Despite a slowdown due to the COVID-19 pandemic, the market remained relatively stable, growing modestly to ₹1.08 lakh crore.

- 2021–22 to 2023–24

A sharp post-pandemic rebound is visible, with revenue rising from ₹1.25 lakh crore in 2021–22 to ₹1.75 lakh crore in 2023–24 — a 40%+ jump in just two years.

This consistent upward curve reflects strong consumer demand, digital adoption and an expanding product ecosystem in India’s beauty and personal care sector.

INDIA’S BEAUTY MARKET – A STORY OF RESILIENCE AND REINVENTION

The Past: From Basic Grooming to Emerging Beauty Culture

In 2014–15, India’s cosmetics and personal care industry was primarily dominated by mass-market essentials — soaps, shampoos, talcum powders and hair oils. Consumption was driven by functionality more than fashion. Brands like HUL, Dabur and Emami were household names, with little competition from global giants or startups.

However, with increasing urbanization, social media influence and the entry of global brands, the narrative began to shift:

- Consumers, especially in metro cities, started exploring skincare routines, makeup and grooming products beyond essentials.

- Rising disposable incomes, better internet access and beauty influencers began shaping aspirational consumption, especially among millennials and Gen Z.

- The introduction of e-commerce gave consumers access to niche, luxury and imported products.

By 2018–19, the industry comfortably reached ₹1 lakh crore — marking the first major milestone of this beauty boom.

The COVID Years: Pause, Panic and Pivot

2020 brought in uncertainty. The COVID-19 pandemic shut down salons, malls and beauty retail stores. Makeup sales plummeted. But surprisingly, the industry showed remarkable resilience:

- Demand for personal hygiene, skincare and natural products increased.

- New-age D2C (Direct-to-Consumer) brands like Mamaearth, Plum, WOW Skin Science and Minimalist captured market share with transparent ingredients and cruelty-free promises.

- Consumers moved to online platforms and beauty-tech solutions like virtual try-ons and AI skin analysis gained popularity.

While growth was modest during 2020–21, it laid the foundation for the digital-first beauty economy India sees today.

The Present: Diverse, Tech-Driven and Expanding

As of FY 2023–24, the market has scaled to ₹1.75 lakh crore, showing not only recovery but a strong acceleration from pre-pandemic projections. The current market is:

- Digitally native: A large chunk of purchases happens online.

- Inclusive: Grooming and skincare are no longer female-dominated; men’s grooming and unisex products are growing rapidly.

- Ingredient-aware: Consumers are reading labels, preferring clean beauty, sustainable packaging and organic/vegan formulations.

- Geographically diverse: Tier II and Tier III cities now represent a major chunk of new growth.

The Future: Towards a ₹3 Lakh Crore Market

The Indian cosmetics and personal care industry is projected to reach ₹3 lakh crore by 2030, riding on:

- Technology Integration: AR try-ons, AI-based skin assessments and personalization.

- Sustainability: Refill stations, zero-waste packaging and eco-conscious consumers.

- Export Potential: With global interest in Ayurveda and Indian formulations, many local brands are scaling internationally.

- Government Support: Initiatives like Startup India, support for MSMEs and improved FSSAI regulation foster a better ecosystem for innovation.

India is moving from consumption-led growth to conscious-led growth, making it one of the most dynamic markets globally.

CONCLUSION: THE MIRROR REFLECTS GROWTH, CONFIDENCE and IDENTITY

In my opinion, the last 10 years of India’s beauty and personal care journey represent more than economic growth. They reflect a shift in cultural mindset — from grooming as a need, to beauty as self-expression, wellness and empowerment.

From ₹65,700 crore to ₹1.75 lakh crore, this industry has proven its ability to not just survive global shocks but to innovate, inspire and evolve with every challenge.

India’s beauty market is no longer just skin deep — it is built on insight, intent and incredible momentum. And it’s just getting started.Frequently Asked Questions

Because every great business starts with the right answers.

A retail pharmacy must have a minimum 10 m² area; wholesale or combined operations require 15 m². Authorities verify premises through a layout plan before issuing a license, ensuring compliance with space and storage norms.

Yes, a registered pharmacist is mandatory for retail pharmacies, though ownership can be by a non-pharmacist. The pharmacist must be registered with the State Pharmacy Council and present during business hours to supervise sales and guide customers.

Retail licenses permit selling medicines to the public via prescriptions; wholesale licenses allow sale in bulk to licensed entities only. Retail needs a pharmacist and 10 m² area; wholesale requires a competent person and 15 m² premises.

State Drugs Control Authority (or FDA) issues retail and wholesale drug licenses. Applications go to the district Drug Licensing Authority. For manufacturing/import, CDSCO is involved. Each state operates its own system, often through online portals.

It usually takes 30–60 days after application and inspection to receive a license. A drug license is valid for 5 years and must be renewed before expiry to continue legal pharmacy operations without disruption.

Starting a retail pharmacy typically requires ₹3–8 lakhs, covering rent, furniture, refrigeration, initial stock and licensing. Larger or wholesale setups need more. Have a financial buffer for at least 6–12 months of initial operations.

Yes, pharmacies are generally profitable due to consistent demand for medicines. Profitability depends on location, product range, sourcing discounts and regulatory compliance. Smart inventory and good service increase customer retention and long-term returns.

Yes, each pharmacy location requires its own drug license and pharmacist. Operating in multiple states means separate licenses per state. Compliance is site-specific, even for chains or branches under one corporate entity.

GST registration is mandatory if annual turnover exceeds ₹40 lakhs (₹20 lakhs in special states) or for inter-state sales. Voluntary registration allows input credit and smoother transactions with suppliers. Most medicines attract 5% GST.