Start Your Journey

Logistics & Transportation Industry: Legal, Licences & Setup Guide

From incorporation to permits and sector-specific licences — here’s a complete, compliance-first roadmap for launching a cargo logistics business in India.

INTRODUCTION

The logistics and transportation industry in India is experiencing rapid growth, fuelled by e-commerce expansion and government initiatives. In 2025, India’s logistics market is projected to reach around $380 billion, growing at a CAGR of over 10%. This sector primarily involves the movement of cargo—storing, transporting and delivering goods across states and even internationally. Starting a logistics business (focused on cargo services) can be highly rewarding, but it also requires navigating a complex web of legal requirements and regulations. From choosing the right business structure and registering your company to obtaining mandatory approvals and licenses, there are many steps to comply with Indian laws. In this comprehensive guide, we will explain everything you need to know to start a logistics and transportation business in India. We’ll cover how to incorporate your company, what approvals and licenses you must get and why they are needed. We will focus on cargo and freight services (goods transportation, warehousing, freight forwarding, etc.) on a pan-India basis, giving you a broad overview applicable across the country. By the end, you should have a clear roadmap for legally launching your logistics venture and you’ll see how professional firms like Lawfinity can assist in the process.

TYPE OF BUSINESS SUITABLE FOR A LOGISTICS COMPANY

One of the first steps is deciding the type of business structure for your logistics startup. In India, you have several options and each structure has its own implications for liability, taxation and ownership:

- Sole Proprietorship: Ideal for small, local operations. It’s easy and cheap to start, but the owner is personally liable for debts and legal issues. It lacks credibility and growth potential, making it risky for larger logistics ventures.

- Partnership Firm or LLP: A traditional partnership is simple to form with a partner but offers no liability protection. LLPs provide limited liability and flexibility, making them safer. However, they may not attract larger clients or investors like a company does.

- Private Limited Company: Best for scaling logistics businesses across India. It’s a separate legal entity, limiting personal liability. Offers high credibility and better funding access. Requires more compliance, but benefits like trust, growth and protection outweigh the regulatory burden.

- OPC or Public Ltd: OPC suits solo founders needing limited liability and company status, though it must convert after crossing certain limits. Public Limited Companies are for large-scale operations seeking public investment and they come with strict compliance rules unsuitable for most startups.

Which structure is the best? We advise structuring your logistics business as a Private Limited Company for most entrepreneurs. It provides the best balance of liability protection, brand credibility and growth potential in the logistics industry. A private company can later be scaled up or even converted to a public company if needed. Of course, the exact choice might vary based on your scale and long-term vision – a small local trucking operation might begin as an LLP or proprietorship – but if you aim to operate across India, serve corporate clients or attract investors, a company structure is ideal. Additionally, foreign logistics companies entering India typically set up an Indian subsidiary company to comply with local laws. Once you have chosen the structure, the next step is business incorporation – registering the entity with the government.

NECESSARY APPROVALS

Starting a cargo and logistics business in India requires obtaining several approvals and registrations from different government authorities. These approvals ensure your business is legally recognized and compliant with general regulations. Below, we list the key approvals you will likely need:

- Company Incorporation (ROC Approval): Register your business with the Ministry of Corporate Affairs to get a Certificate of Incorporation. It creates your business as a legal entity, especially necessary for Pvt Ltd or LLP setups. Without it, your company isn't legally recognized.

- GST Registration: Logistics companies must register for GST due to inter-state goods movement. It enables you to generate e-way bills, collect GST from clients and claim input tax credits. This is essential for tax compliance and smooth goods transportation across India.

- PAN and TAN Registration: PAN is needed for all tax filings and financial activities. TAN is required if your business deducts TDS from salaries or contractor payments. Both are issued by the Income Tax Department and are essential for lawful business operations.

- Import-Export Code (IEC): Required for businesses involved in international shipping, customs or import/export. This 10-digit code from DGFT allows legal clearance of cargo across borders. It’s a one-time registration and essential for expanding into global logistics or freight forwarding.

- Professional Tax Registration: Some states levy a small tax on professionals and employees. You must register and pay regularly if operating in states like Maharashtra or Karnataka. It ensures compliance with state laws and avoids penalties for non-registration or non-payment.

- Shops and Establishments Registration: Required if you operate an office, warehouse or logistics center. It governs employee welfare, working hours and workplace conditions. Issued by the state’s labour or municipal department, it's necessary to establish and operate legally from physical premises.

- Trade License (Municipal License): Issued by the local municipal body, it allows you to run your logistics business (e.g., warehouse, office) within city limits. Ensures compliance with local zoning and safety regulations. Required before beginning operations in many urban areas.

- EPF and ESIC Registrations: Mandatory when you hire 10+ (ESIC) or 20+ (EPF) employees. EPF ensures retirement savings; ESIC covers healthcare for workers. Issued by EPFO and ESIC, these are crucial for labor law compliance in logistics businesses with field and office staff.

- Fire Department NOC: If you store goods or operate a warehouse, this approval confirms your premises meet fire safety norms. Issued by the local Fire Department, it’s essential for legally starting storage operations and ensuring life/property protection and insurance eligibility.

- Environmental Clearance (if applicable): If your logistics operations involve pollution risk (e.g., fuel storage, DG sets, hazardous goods), you may need Pollution Control Board NOC. It ensures environmental safety and legal compliance. Routine transport or warehouses may not need this unless specific triggers exist.

REQUIRED LICENSES

In addition to general business approvals, you will need certain specific licenses and permits to run a logistics and transportation company. These licenses are directly related to the transport of goods and the services you offer. Below is a list of key licenses required for a cargo logistics business in India, with brief explanations (3-4 sentences each):

- Commercial Vehicle Permits (Goods Carrier Permits): Required for trucks transporting goods. Issued by RTOs, state permits cover intrastate routes, national permits cover multiple states. Most cargo vehicles need this. Operating without permits can lead to fines or seizure under the Motor Vehicles Act.

- Commercial Driver’s License: All drivers must hold a valid commercial license matching the vehicle type. Some states require driver badges too. Businesses should verify licenses and provide safety training. Proper documentation is vital for compliance, insurance and legal accountability in accidents or inspections.

- Multimodal Transport Operator (MTO) Registration: If offering end-to-end logistics using multiple modes (road, rail, sea, air), register under the Multimodal Transportation of Goods Act. It allows you to issue combined contracts and bills of lading. MTO registration enhances legal protection and business credibility.

- Common Carrier Registration (Carriage by Road Act): Logistics firms transporting goods for the public must register as “common carriers” with the State Transport Authority. This certificate formalizes your operations, limits liability and ensures compliance with transportation regulations under the Carriage by Road Act, 2007.

- Goods and Service Tax (GST) License for Transporter: If you operate as a Goods Transport Agency (GTA), ensure your GST registration reflects this. Certain transport services fall under reverse charge mechanism. Proper classification allows legal billing, tax credits for clients and avoids GST-related penalties.

- Customs Broker License (if offering customs clearance): Needed if you offer customs clearance for imports/exports. Issued by the Customs Department after exams and eligibility checks. It authorizes you to handle documentation and clear goods through customs. Many firms hire licensed brokers instead of obtaining this in-house.

- Freight Forwarder Registrations (IATA & ACAAI): IATA registration is crucial for air cargo agents to book space with airlines. ACAAI membership adds credibility in India. While not government-mandated, these industry certifications are essential to access global freight networks and win major air logistics contracts.

- Air Cargo Agent (AAI) License: If you operate cargo facilities at airports, obtain an Air Cargo Agent license from Airports Authority of India. It ensures you meet infrastructure and security norms. Required only if operating directly at terminals—not for those using third-party agents.

- Import-Export Related Licenses: Beyond IEC, transporting certain goods (e.g., chemicals, defense items) may need DGFT or department-specific licenses. If fumigating or packaging exports, relevant approvals (e.g., APEDA, Fumigation License) are required. These are niche, but critical for specialized international logistics operations.

- Warehousing License / WDRA Registration: If you store goods, ensure your warehouse complies with safety and regulatory norms. For agricultural goods, WDRA registration allows issuing negotiable receipts. For other goods, licenses depend on type—like food (FSSAI) or chemicals (hazardous clearance)—plus basic fire and shop licenses.

- FSSAI License (for food transport/storage): Required for businesses handling edible goods. Transporters and storage providers must register as Food Business Operators. FSSAI ensures hygiene standards are met. A central or state license is needed based on scale and geography. Non-compliance leads to fines or goods seizure.

- Hazardous Materials Transport License: Transporting flammable, toxic or dangerous goods requires special licenses from transport and safety authorities. Vehicles must display hazard signage and drivers need training. Depending on the cargo, approvals may come from PESO, Pollution Control Boards or under the Explosives Act.

- 3PL and Courier License (if applicable): No single license for 3PL, but you must ensure warehousing, transport and staffing are properly licensed. For international courier services, register under Courier Imports and Exports (Clearance) Regulations with customs. Domestic services mainly need GST and establishment registration.

WHY SUCH APPROVALS AND LICENSES ARE NEEDED

You might be wondering, why go through the hassle of getting all these approvals and licenses? Simply put, these requirements exist to ensure that logistics businesses operate safely, legally and responsibly:

- Legal Compliance: Without valid licenses like vehicle permits or carrier registration, authorities can impose fines or shut down operations. Staying compliant protects your logistics business from legal action, enforcement raids and disruptions, ensuring operations continue without interference or regulatory trouble.

- Safety and Accountability: Approvals like fitness certificates, hazardous goods licenses and driver validations promote public safety. Registered operators have defined legal protections and responsibilities, helping prevent accidents and ensuring fair accountability in case of losses, damage or liability claims.

- Smooth Operations Across Regions: Proper registrations like GST, state permits and IEC ensure goods move smoothly across state borders or customs without delays. This reduces detentions, avoids penalties at checkpoints and accelerates delivery timelines for domestic and international logistics operations.

- Client Confidence and Business Credibility: Valid licenses demonstrate professionalism and reliability. Large clients prefer vendors with GST, FSSAI or IATA registrations. Being fully compliant improves your chances of getting contracts, reduces client concerns and helps build long-term partnerships with reputable businesses.

- Financial and Insurance Benefits: Most insurance claims or bank loans require valid business registrations. Without compliance, claims may be denied. Licensing also unlocks schemes like MSME benefits and Udyam registration, helping reduce risk, gain funding and protect your logistics business financially.

HOW LAWFNITY CAN HELP YOU ESTABLISH YOUR LOGISTICS BUSINESS

Setting up a logistics company involves juggling many legal requirements and this is where Lawfinity can be your trusted partner. Lawfinity is a full-service business consulting firm that specializes in business registration, licensing and compliance solutions in India. Here’s how Lawfinity can help you in establishing your desired logistics business:

- End-to-End Business Incorporation: Lawfinity’s experts handle complete company setup, from choosing the right structure to filing incorporation forms. They manage DINs, digital signatures and legal drafting, ensuring error-free and quick registration, so your logistics business starts on a solid legal foundation.

- Regulatory Approvals and Licensing: Lawfinity obtains all necessary licenses like GST, IEC, ESI/EPF and Shop Act. They also handle sector-specific needs, including vehicle permits and insurance, allowing logistics startups to become fully compliant without juggling paperwork or coordinating with multiple authorities.

- Legal and Compliance Advisory: Lawfinity offers ongoing compliance support—filing GST, TDS and ROC returns, plus managing renewals. With presence across India, they handle location-specific approvals too, ensuring logistics businesses remain legally compliant while scaling across states or expanding operations.

- Customized Solutions for Logistics Industry: They offer industry-specific legal support like carrier contracts, liability clauses, employee compliance and insurance guidance. Lawfinity doesn’t stop at paperwork—they structure your legal documents to protect your logistics operations from disputes, penalties and regulatory challenges.

- One-Stop Support: Lawfinity combines legal, tax and compliance services into a single platform, eliminating the need for multiple consultants. From incorporation to filings, they streamline everything, helping logistics businesses save time, avoid errors and grow confidently with full legal backing.

(Feel free to contact Lawfinity for a consultation – having expert guidance is often the key to starting up right, especially in a compliance-heavy industry like logistics.)

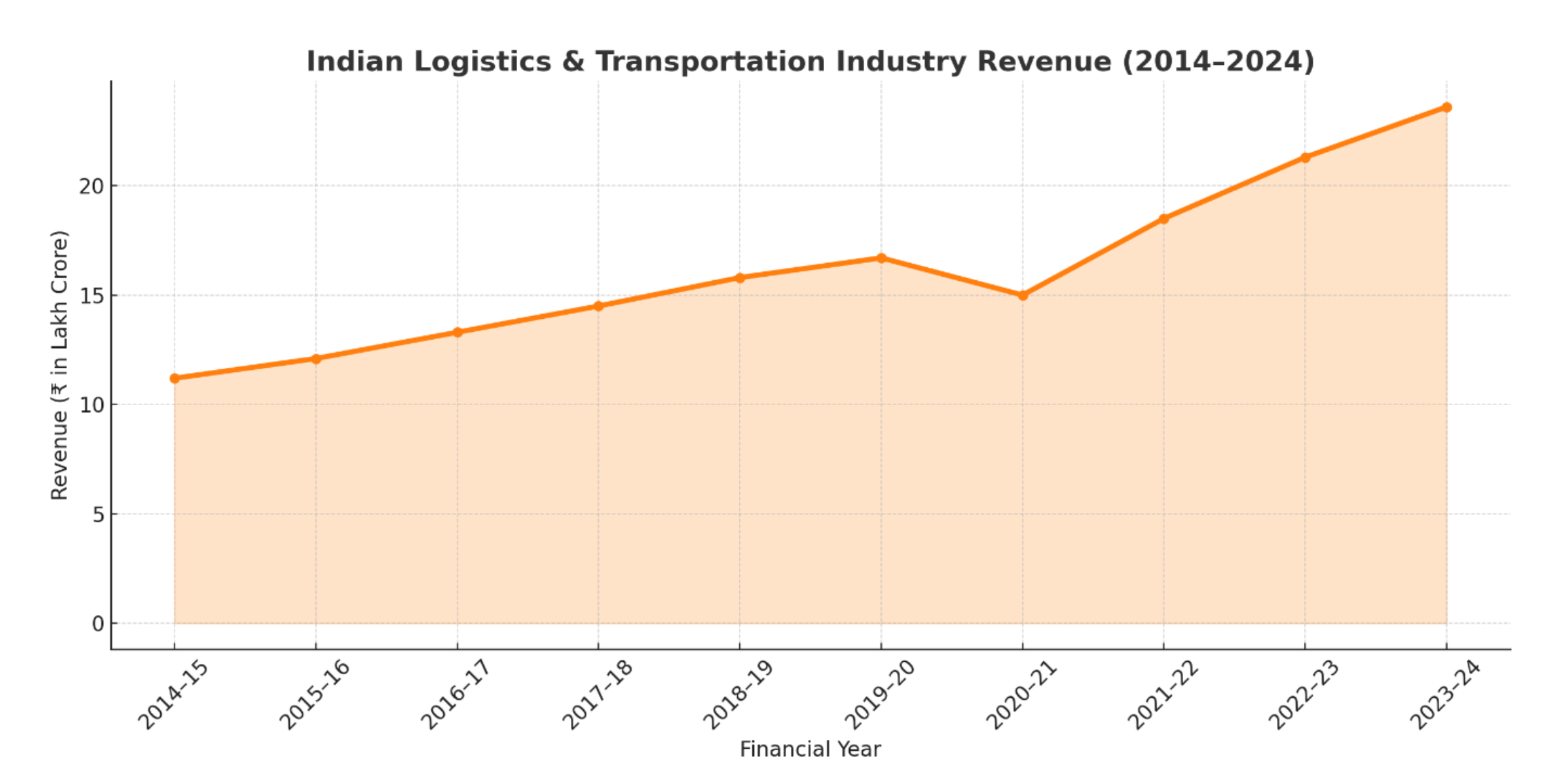

INDIAN LOGISTICS & TRANSPORTATION INDUSTRY REVENUE (2014–2024)

Source: India Brand Equity Foundation, National Logistics Policy Reports (MoCI, 2022–2024), Economic Survey of India (2018–2024), DPIIT Reports on Logistics Performance, CRISIL and FICCI-KPMG Logistics Sector Outlook

AUTHOR’S OPINION: LOGISTICS – FROM BACKBONE TO SMART GROWTH ENABLER

The Past: Backbone of Traditional Commerce (2014–2020)

From FY 2014–15 to FY 2019–20, India’s logistics and transportation sector grew from ₹11.2 lakh crore to ₹16.7 lakh crore. This growth was largely driven by traditional sectors like agriculture, FMCG, steel and cement, along with infrastructure spending on highways and rail freight. However, the ecosystem was still fragmented, with high logistics costs (14% of GDP) due to unorganized warehousing, poor multimodal integration and inefficient last-mile delivery.

Despite these inefficiencies, the industry remained a backbone for India’s domestic trade and manufacturing, supported by investments in road development, port modernization and railway capacity.

The Present: Policy-Driven Reform & Digital Surge

FY 2020–21 saw a contraction due to COVID-19, with revenue falling to ₹15 lakh crore. But this slowdown triggered a digital transformation across the supply chain. The introduction of the National Logistics Policy, adoption of e-way bills, FASTag, RFID freight tracking and private warehousing investment helped formalize and digitize logistics operations.

By FY 2023–24, the industry rebounded strongly to ₹23.6 lakh crore, supported by booming e-commerce, cold chain expansion, electric vehicle logistics and public investments in multi-modal logistics parks (MMLPs). India’s logistics landscape today is being shaped by smart warehousing, route optimization, last-mile EV delivery and AI-based fleet management.

The Future: Integrated, Greener, Faster

Looking ahead, India’s logistics sector is expected to grow at a CAGR of 8–10%, touching nearly ₹30 lakh crore by FY 2026–27. What’s exciting is the qualitative shift — from fragmented operators to data-driven, green and integrated logistics ecosystems.

Government reforms like ULIP (Unified Logistics Interface Platform), Dedicated Freight Corridors and Gati Shakti master plans will enable seamless interconnectivity between ports, roads, rail and air. Warehousing will become tech-enabled and Tier 2 and Tier 3 cities will emerge as key logistics hubs.

With India aiming to bring down logistics costs to 8% of GDP, expect the sector to unlock export competitiveness, improve inventory efficiencies and support Make in India goals.

CONCLUSION: MORE THAN MOVEMENT — IT’S A MULTIPLIER

From my perspective, logistics in India is no longer a backend function. It is a growth multiplier. It determines how fast medicines reach rural clinics, how quickly e-commerce orders arrive and how efficiently factories restock.

The growth from ₹11.2 lakh crore to ₹23.6 lakh crore reflects more than industry expansion — it shows a nation preparing for supply chain resilience, digital infrastructure and economic scalability.

India’s logistics journey is not just about moving goods — it's about moving India forward.

Frequently Asked Questions

Because every great business starts with the right answers.

A Private Limited Company is ideal for logistics startups due to limited liability, credibility and funding ease. Sole Proprietorship or LLP suits smaller operations.

One company registration suffices nationally, but local permits like Shops Act, trade license and National Permits are needed per state for smooth logistics operations.

Starting costs vary: ₹5–30 lakhs for asset-light models, ₹1 crore+ for owning trucks/warehouses. Loans need proper registrations, GST and business incorporation.

You'll need vehicle permits, commercial registration, driver licenses, insurance, GST, company registration and possibly FSSAI or hazmat licenses depending on transported goods.

IEC is not required for domestic logistics. It’s only necessary if you're importing/exporting goods or planning to expand into international freight forwarding.

No separate license for 3PL. Standard compliance suffices. Build trust via performance, client references, good tech and registering on logistics marketplaces or bidding platforms.

File GST, TDS, income tax, ROC returns, renew permits, insurance, fitness and licenses. Maintain labor law compliance and vehicle PUC certificates regularly.

IATA/FIATA not mandatory, but useful for air freight booking and global trust. MTO is needed for multimodal transport under Indian law.

Use maintained vehicles, train drivers, install GPS, insure goods and follow packaging/safety norms. Precautions build reliability and reduce transit loss risks.