Start Your Journey

Start Your Petroleum & Gas Venture the Right Way

From LPG dealerships to CNG stations and CGD projects — we help you get all necessary approvals, licenses, and legal support to launch a fully compliant fuel business in India.

INTRODUCTION

The Indian energy ecosystem has gone under significant change in 2017. Indian government’s vision of 24×7 affordable, quality power for all; thrust on renewable energy with enhanced capacity target of 175 GW by 2022; growing interest in electric vehicles and energy storage and lastly, liberalisation of the natural gas market. As the world’s third-largest energy consumer, the sector remains one of the fastest growing supported by economic growth, urbanisation and quest for cleaner fuel. Government schemes like the Pradhan Mantri Ujjwala Yojana have brought LPG in reach for rural households and large-scale push for city gas distribution networks is making lives easier by ensuring 24×7 availability of cleaner alternatives like CNG and PNG in urban and semi-urban settings. This has opened up a huge swathe of business opportunities in distribution, retailing, marketing and infrastructure development.

If you are a business owner looking at this sector, there are various opportunities – right from LPG distributorships to CNG and LNG filling stations to petroleum product dealerships and projects in city gas or pipeline trading adverts. But getting into this industry requires intimate familiarity with regulatory rules, capital budgeting and compliance with stringent safety and environmental requirements. Right from deciding which is the best business structure, say, a private limited company or a LLP to getting the necessary approvals from bodies, such as PESO, Petroleum Ministry or PNGRB, this is a process-heavy journey. This guide takes you through the process and assists you in forming a legally compliant and profitable petroleum or gas business in India.

BUSINESS STRUCTURE: WHAT’S THE BEST FIT?

Starting with the legal structure is critical. The key options include:

- Sole Proprietorship / Partnership: These are easy to start and manage, making them great for small shops or services. But in petroleum or gas, where risks and liabilities are high, this structure leaves your personal assets exposed — not a smart long-term bet.

- Limited Liability Partnership (LLP): LLPs strike a nice balance — you get limited liability without the heavy compliance of a company. If you are starting a modest CNG setup or a small LPG business, this can be a safer, flexible structure, especially if plans change later.

- Private Limited Company: This is the go-to model for serious players. You will need to handle more paperwork, but it adds trust, helps raise funds and is perfect for high-investment projects like fuel stations, bulk storage or city gas distribution networks.

- One Person Company (OPC): OPC lets a solo entrepreneur limit liability, which sounds good on paper. But realistically, petroleum and gas businesses often need more hands or partnerships, so OPC may not suit the scale or collaboration such ventures typically require.

- Public Limited Company: This structure is overkill for most newcomers. It’s designed for big corporations and IPO-bound giants. Unless you are planning a massive pan-India gas chain, the compliance and public scrutiny aren’t worth it at the startup stage.

Best advice:

- For smaller ventures or experimental models, start with an LLP to limit risk.

- For larger-scale, funding-ready setups, a Private Limited Company provides future-proof scalability.

NECESSARY APPROVALS

- Business Incorporation & PAN/GST: First things first, you will need to register your business with the Ministry of Corporate Affairs (MCA) and get your PAN and GST numbers. These IDs aren’t just formalities, they are absolutely essential for applying for any petroleum or gas-related licenses.

- Land Use & Zoning Clearances: You can’t just open a fuel station or gas storage unit anywhere. The land must be approved for such use, with proper zoning documents or occupancy certificates. Sites near schools, hospitals or highways often face restrictions, so plan wisely.

- Environmental Clearance: If your setup involves storing or handling large volumes of gas or fuel, you will need approval from the Pollution Control Board. This clearance confirms that you’ve got plans for spill control, emissions and waste treatment — no shortcuts here.

- Fire Safety NOC: This is a must-have. You need to show the fire department that your premises are equipped with fire extinguishers, alarms, hydrants and a clear emergency exit plan. They won’t give the green light until every safety box is ticked.

- Police NOC / Security Clearance: Because fuel and gas come under critical infrastructure, the police want to verify who’s running the show and what’s happening on-site. This check ensures that your setup isn’t a security risk and that all stakeholders are clean and legitimate.

- PESO / Explosives Approval: Handling flammable substances? Then you are definitely dealing with PESO. Whether it’s LPG tanks, CNG dispensers or underground storage — the Petroleum & Explosives Safety Organisation ensures everything meets strict safety standards. You can’t legally operate without this stamp of approval.

REQUIRED LICENSES

- LPG Dealership License: To run an LPG agency, you will need to apply to companies like IOCL or BPCL. They check if you meet eligibility on age, education and finance. You will also need a compliant godown, delivery system and PESO approvals before getting started.

- PESO Forms E & F License: If you are storing or refilling gas cylinders (LPG, CNG, etc.), you will need safety clearances from PESO. Form E gives structural approval, while Form F is the actual storage license. Without these, operating legally — and safely — just isn’t possible.

- PNGRB City Gas Distribution Authorization: Want to supply piped or compressed gas in cities? You will need PNGRB's nod under a bidding system. If you win the authorization, you can operate in specific zones — but it comes with strict safety, quality and service obligations.

- Petrol Pump / OMC Outlet Authorization: Getting a petrol pump dealership from IOC, BPCL or HPCL means meeting land, investment and experience criteria. Once selected, you will sign a franchise agreement that lets you legally sell fuel — with branding, training and supply support from the oil company.

- Environmental and SPCB Consent: Before starting and again when you begin operations, you must get approvals from the Pollution Control Board. Called CTE (Consent to Establish) and CTO (Consent to Operate), these ensure your fuel station or gas unit isn’t harming air, water or land.

- Fire NOC (Annual Renewal): It’s not enough to get a Fire NOC once. In most states, you have to renew it yearly. Authorities inspect your fire extinguishers, alarms, hydrants and exits — just to confirm everything’s working and your staff can handle emergencies.

- DGMS Mineworker Safety (for pipelines/underground): If your project involves underground fuel lines or pressurized storage that meets certain thresholds, you will need approval from the DGMS. It’s about worker safety and emergency planning — usually not needed for basic stations but crucial for bigger infrastructure setups.

- Shop & Establishment / GST: Like any other business, you will need to register under your state’s labour laws and under GST. These are standard, especially since fuel and gas outlets usually cross the ₹20–40 lakh annual turnover limits and employ multiple workers.

- Transportation Permits: If you are moving fuel or gas cylinders via truck or tanker, you will need special permits. This includes vehicle fitness certificates, hazardous goods transport approval, driver endorsements and PESO’s green light — all of which prioritize public safety during transport.

WHY YOU NEED THESE APPROVALS & LICENSES

- Safety First: Petroleum and gas aren’t ordinary products — they can ignite, leak or even cause fatal accidents. That’s why approvals from PESO, the fire department and pollution boards aren’t red tape — they’re essential to protect lives, property and the environment.

- Legal Compliance: You can’t just store or sell fuel like any regular product. Without approvals from PNGRB or tie-ups with OMCs, your business is considered illegal — and authorities can shut you down, impose fines or even file criminal charges.

- Tax and Revenue Tracking: Licenses like GST and dealership contracts help the government keep track of every litre sold. This ensures you are paying your fair share of taxes and stops illegal fuel sales that often bypass safety and tax norms.

- Investor & Public Confidence: Investors, banks or even family backers will hesitate to fund a fuel business unless every license is in place. Proper approvals show that you are serious, lawful and set up for long-term operations — which builds trust from day one.

- Brand & Commercial Trust: Your dealership license isn’t just paper — it’s the golden ticket to work with giants like IOCL or HPCL. PESO certification also reassures regulators and customers that your site is safe, legal and professionally operated.

HOW LAWFINITY CAN HELP YOU ESTABLISH YOUR PETROLEUM & GAS BUSINESS

Honestly, starting something in the petroleum or gas space in India is way more than just putting money into land or equipment. There is so much paperwork, so many approvals from different departments and if you miss even one, it can hold up your whole project. Fire safety, pollution board, local police, excise, PESO it’s all part of it. And no one tells you exactly how it all fits together.

We, at Lawfinity have been doing this for a while now. We have worked with people trying to set up petrol pumps, LPG dealerships, CNG outlets, even CGD bidding. And we have seen how messy and slow it gets when the legal and compliance part isn’t handled properly.

We are here to take that off your plate. We know what goes where, which office to file with, what docs get flagged, and how to keep things moving. So instead of chasing signatures and NOCs, you can get to building the actual business you had in mind.

Our Comprehensive Services Include:

- Business Incorporation and Legal Structuring: We assist in selecting the most suitable entity structure — Private Limited Company or LLP — and handle company incorporation, PAN, TAN, and GST registrations to build a legally recognized foundation for your operations.

- Land Vetting and Zoning Clearances: Before you commit to a site, our legal team verifies land use permissions, zoning restrictions, environmental sensitivity, and proximity to restricted areas (such as schools or hospitals) to prevent future obstacles.

- PESO Licensing & Explosives Approvals: We manage the entire process of applying for licenses from the Petroleum and Explosives Safety Organisation (PESO) including Form XIV, XV, and XXIV covering fuel storage, refilling, and hazardous goods handling.

- Oil Marketing Company (OMC) Dealership Setup: From application submission to document verification and land inspection, we coordinate with PSU and private OMCs (IOCL, BPCL, HPCL, Reliance, etc.) to streamline your dealership acquisition process.

- State Pollution Control Board and Fire Safety Approvals: We file and follow up on Consent to Establish (CTE), Consent to Operate (CTO), and Fire NOC applications, ensuring your infrastructure meets environmental and fire safety regulations.

- RTO Permits and Legal Metrology Compliance: We help secure hazardous goods transport permits, driver endorsements, and calibration certificates from the Legal Metrology Department — especially important for mobile fuel delivery and tanker-based operations.

- PNGRB Licensing Advisory for CGD Projects: For City Gas Distribution players, we provide advisory and compliance support during PNGRB bidding, ensuring your legal documents, eligibility criteria, and consortium structures meet all regulatory conditions.

- Drafting & Review of Legal Documents: Our team drafts and vets critical documents such as lease deeds, dealership agreements, storage contracts, NDAs, MoUs, and vendor SLAs, customized to petroleum and gas business operations.

- Regulatory Due Diligence & Compliance Audits: Whether you're acquiring an existing unit or facing an inspection, we conduct detailed audits and prepare compliance reports to identify legal gaps and ensure readiness.

At Lawfinity India, we serve as a one-stop legal partner for your petroleum and gas business. Our expertise lies in aligning your venture with the complex legal frameworks under the Petroleum Act, Explosives Act, PNGRB Act, and respective state regulations.

From first-time entrepreneurs to seasoned infrastructure developers, our clients benefit from our proactive support, accuracy in documentation, and strong liaison with licensing authorities across India.

Ready to launch or expand your petroleum or gas business the compliant way?

Visit www.lawfinity.in or contact our team today for a consultation. Lawfinity India – Your trusted legal partner in India’s ever-evolving energy and fuel sector.

FUELING INDIA’S ECONOMY – A DECADE OF STRATEGIC SHIFTS

Source: Official disclosures and industry reports. Key data points cited above come from company financial results (e.g. Indian Oil FY2023-24, GAIL FY2024, BPCL FY2023-24) and forecasts/reviews (IEA, India Brand Equity Foundation, MoPNG releases). Trends match aggregate consumption statistics (India’s petroleum use grew to ~233.3 MMT in FY2024) and policy changes.

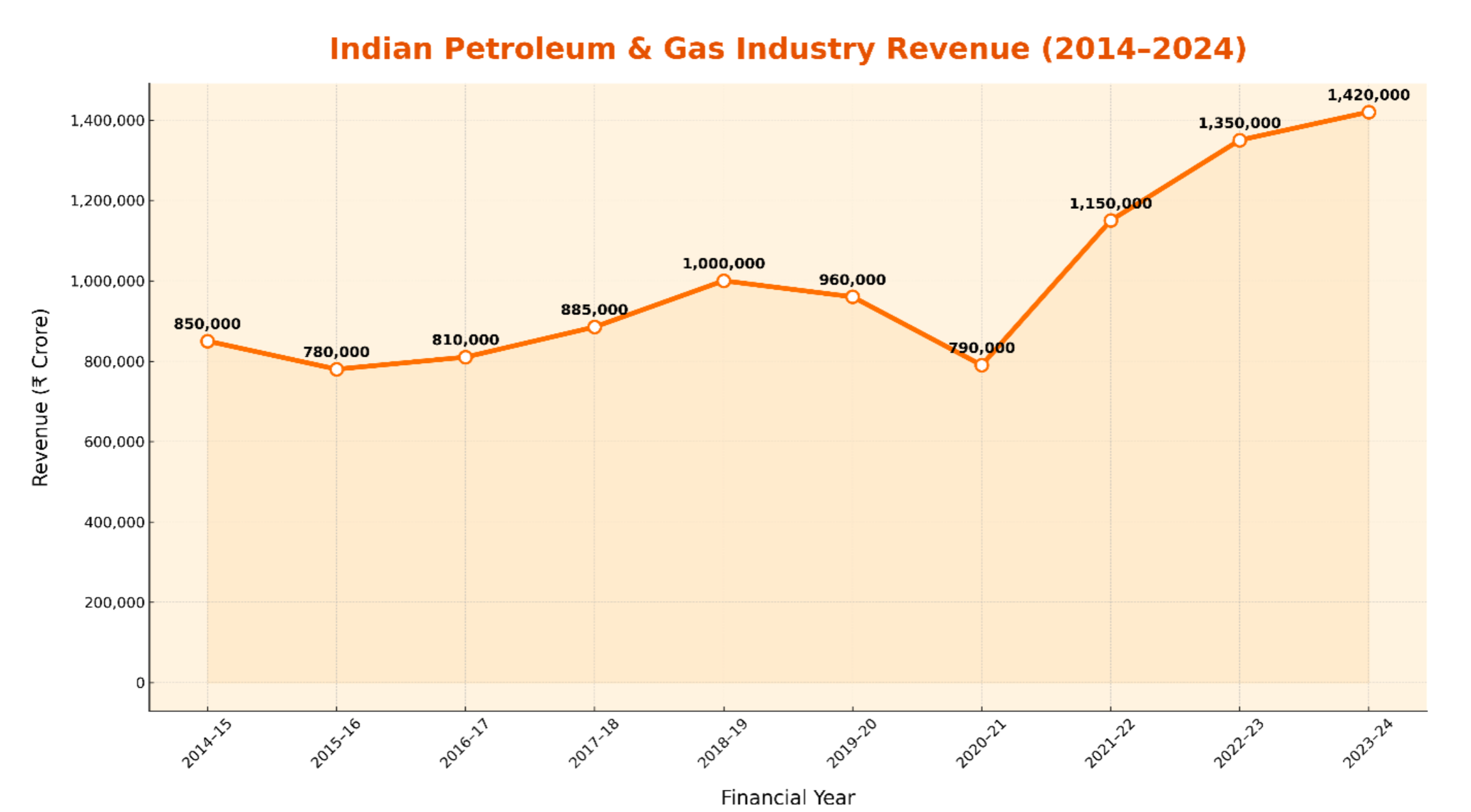

INDUSTRY REVENUE INSIGHTS (2014–2024)

The graph showcases the estimated total revenue of India’s petroleum and gas industry over the last 10 years (FY 2014–15 to FY 2023–24), in INR crore.

Key Observations:

- The industry grew steadily from ₹8.5 lakh crore in 2014–15 to a peak of ₹10 lakh crore in 2018–19, owing to rising fuel consumption and moderate global crude prices.

- In 2020–21, revenue dipped sharply to ₹7.9 lakh crore due to the COVID-19 pandemic, which caused a collapse in global oil prices and domestic demand.

- From 2021–22 onwards, the industry witnessed a strong resurgence, driven by:

- Increased consumption post-pandemic

- Higher international crude prices

- Greater reliance on domestic refining and marketing

- Revenue touched ₹14.2 lakh crore in 2023–24, marking the highest ever turnover in India’s petroleum and gas sector history.

AUTHOR’S OPINION: PAST, PRESENT & FUTURE OF PETROLEUM AND GAS INDUSTRY

The Past: Foundation of Energy Security

In the early half of the last decade, India’s petroleum and gas industry was centered on import-dependency, PSU-led refining dominance and a tightly regulated pricing regime. Despite volatile global oil prices, the sector managed stable revenue growth, supported by:

- Robust fuel demand from transport and manufacturing sectors

- Continued expansion of LPG penetration (especially through government schemes like Ujjwala Yojana)

- Growth in domestic refining capacity led by companies like IOCL, Reliance and BPCL

However, limited private participation and exposure to crude price fluctuations kept the industry vulnerable to global supply shocks.

The Present: Recovery, Reform and Realignment

The post-COVID years brought massive disruption — but also transformation. In 2020, when global oil demand crashed, Indian refiners faced margin pressure and falling consumption. But the sector showed resilience:

- LPG and piped gas usage in households rose

- Marketing margins were recalibrated

- State-owned firms invested in refinery upgrades and clean energy transitions

By 2023–24, as revenue crossed ₹14.2 lakh crore, the industry became more digitized, decarbonization-aware and policy-driven. Deregulation of fuel prices, expansion of City Gas Distribution (CGD) and opening up for foreign investment began reshaping the sector.

The Future: Diversification Beyond Fossil Fuels

While the industry has recovered strongly, its future will depend on strategic diversification:

- Green Hydrogen & Biofuels: OMCs (Oil Marketing Companies) are now investing in ethanol blending, hydrogen plants and CBG (Compressed Bio-Gas).

- Natural Gas as a Bridge Fuel: Government push to make India a gas-based economy (15% share target by 2030) will lead to pipeline expansion and CGD investments.

- EV Disruption & Net Zero Targets: With the rise of EVs, the role of traditional fuel will decline in urban centers. Companies will need to pivot toward charging infrastructure and energy-as-a-service models.

- Global Volatility & Localization: Reducing import dependence via domestic exploration (NELP, HELP) and strategic oil reserves will be critical.

CONCLUSION: ADAPTING TO STAY RELEVANT

In my view, the Indian petroleum and gas industry has truly shown its resilience and adaptability in recent years. Despite facing global oil price swings, mounting environmental concerns and ever-evolving government regulations, it continues to power our economy while gradually transforming itself. What was once a purely fossil-fuel-driven sector is now entering a new phase — one that blends traditional energy sources with emerging ones like natural gas, biofuels, green hydrogen and renewables.

We are seeing more than just oil tankers and pipelines — there’s a growing focus on building smarter infrastructure, cleaner fuels and tech-driven operations. Initiatives like expanding city gas distribution, investing in hydrogen fuel technology and converting vehicles to cleaner fuels show that India isn’t just reacting to global energy trends — it’s participating in shaping them.

But the real shift, I believe, lies in mindset. The future of India’s energy isn’t about how much fuel we use, but how intelligently we manage the transition from carbon-heavy to carbon-light systems. Decarbonization, digital innovation and decentralization of energy production will define the industry going forward. If India can get this balance right, the petroleum and gas sector will remain not only relevant but a strong pillar of our sustainable growth story.

Frequently Asked Questions

Because every great business starts with the right answers.

Indian citizen aged 21–55, educational qualification (10th pass to graduate), relevant experience, meeting minimum net worth criteria—varies by OMC.

Oil/gas companies bid through PNGRB for Geographical Areas (GA); winning the bid grants CGD license to build pipeline and CNG/piped gas network.

Submit Form E for structural design approval, then Form F after construction and equipment build-out; includes layout, HAZOP safety report and inspection.

Often no—unless you exceed thresholds for emissions or wastewater. But SPCB consent is still commonly required and always check local rules.

Yes, LLPs and Pvt Ltd companies can apply for all petroleum/gas licenses, often easier to transfer and wind up than individuals.

Typically, 6–12 months: land acquisition, approvals, asset commissioning, dealer authorizations. Larger timelines for CGD projects.

No—dealership and CGD/PNGRB licenses are site-specific. Additional outlets require new applications per site/GA.

For LPG/petrol pump, yes – usually 3+ years of business or relevant experience. For CGD, technical and financial credentials matter in the PNGRB bids.

Ranges from hefty fines, detention of goods, license cancellation, business shutdown to personal imprisonment in worst cases.