Start Your Journey

Build Legally. Grow Boldly. Succeed in Indian Real Estate.

Navigate the complexities of real estate with confidence. Whether you're launching a development project or setting up a brokerage, our legal guide helps you cut through red tape and build a sustainable future.

INTRODUCTION

The real estate industry in India is buzzing. The industry contributes around 8 per cent of the country’s GDP and is expected to be USD 1 trillion market by 2030. This growth is attractive to would-be entrepreneurs, but the industry is heavily regulated by the Government.

Launching a real estate business is not for the faint-hearted as it is far more than pretty presentations and brochures, a real estate business has to navigate legislations like the Real Estate (Regulation) Act (RERA) as well as municipal laws while also servicing its customers successfully. This guide outlines the critical legal and practical steps to starting a real estate business in India – including deciding on the appropriate business structure and obtaining all permissions, registrations and licences required in India.

Choosing the Right Business Structure

One of the first and most important steps in starting a real estate business in India is selecting the most appropriate business structure model. The choice of structure impacts everything, from liability protection and taxation to fundraising and regulatory approvals.

The common entity types in India include Sole Proprietorship, Partnership Firm, Limited Liability Partnership (LLP), One Person Company (OPC) and Private Limited Company. Each has different legal and compliance requirements, which must be aligned with your business goals, scale and the nature of your operations.

- Sole Proprietorship or Partnership: Suitable for small brokers or consultants, these structures are easy and low-cost but lack limited liability and perpetual succession. They face challenges in securing bank loans or formal contracts, making them less ideal for large-scale real estate projects.

- Limited Liability Partnership (LLP): LLPs offer limited liability with operational flexibility, ideal for mid-sized developers or consultancies. With moderate compliance, audit exemptions under thresholds and eligibility for RERA registration, LLPs are efficient and legally robust for property aggregation or boutique development ventures.

- One Person Company (OPC): Best for solo real estate professionals, OPCs provide limited liability and legal identity under a single owner. While fundraising is limited, they’re ideal for consultants seeking credibility. Conversion to a Private Limited is mandatory if turnover exceeds ₹2 crore.

- Private Limited Company: Most suited for developers and large agencies, this structure offers scalability, limited liability and access to funding. Preferred by investors and RERA, it enables formal contracts and professional operations, essential for high-value projects or institutional collaborations in real estate.

Which structure is best? For individual consultants or agents, an LLP or OPC can provide a balance of flexibility and liability protection. For boutique agencies or investment firms, an LLP allows compliance without the burden of extensive corporate governance.

However, if you plan to develop residential or commercial projects, manage third-party investments or enter joint ventures, a Private Limited Company is strongly recommended. It not only satisfies regulatory requirements like RERA and GST but also improves your credibility in high-value transactions.

Whichever entity you choose, make sure to complete the formal incorporation process including name reservation, DIN and DSC for directors/partners, registration with the Ministry of Corporate Affairs and PAN/TAN issuance before moving on to licenses and project-level approvals.

NECESSARY APPROVALS

Regardless of business form, any real estate project will need multiple statutory approvals to move forward. These ensure land use and building plans are legal and that safety/environmental standards are met. Essential approvals typically include:

- Land Use and Title Clearance: Ensure the land is zoned for development and not under agriculture. Obtain NA conversion if required, verify ownership through sale deed or encumbrance certificate and register all documents to prevent future legal disputes or claims over property title.

- Layout and Building Plan Sanction: Submit layout and building plans to the local authority for approval under zoning and FSI rules. Only after sanction can you obtain a Commencement Certificate to begin construction, ensuring compliance with building codes and local urban development regulations.

- Environmental & Pollution Clearances: Large projects may need environmental clearance and Consent to Establish from the State Pollution Control Board. These ensure eco-friendly construction with provisions for waste management, green areas and rainwater harvesting, as required under environmental and municipal laws.

- Utility and Safety NOCs: Secure NOCs for fire safety, water, sewage and electricity from respective departments. These confirm the project meets essential safety and utility standards and is connected to civic infrastructure prerequisites for legal occupation, sale or use of the building.

- Occupancy/Completion Certificate: Once construction is complete, apply for the Completion and Occupancy Certificates. These confirm adherence to sanctioned plans and safety standards. An OC is mandatory to legally occupy, sell or lease any unit and without it, penalties and service bans may apply.

Each of the above approvals typically involves submitting detailed documents and waiting for departmental sign-offs. For example, the developer may need to submit soil test reports, structural designs, firefighting layouts and carry out inspections.Note that specific requirements can vary by state/city – for instance, high-rise projects in metro areas may need additional NOCs (airport height clearance, telecom, etc.). Always check with local authorities for any extra regional clearances.

ESSENTIAL LICENSES AND REGISTRATIONS

Beyond project approvals, your business itself must be legally registered and licensed. Key steps include:

- Business Entity Registration: Register your company or LLP with the Ministry of Corporate Affairs to obtain a Certificate of Incorporation. This enables you to legally operate, open business accounts, enter contracts and protects owners’ personal assets from business liabilities.

- RERA Registration (Developer and Agent): Developers must register projects exceeding 500 sq. m. or 8 units under RERA before marketing. Agents also require RERA registration. This ensures legal operation, protects buyers, mandates fund segregation and enhances credibility with disclosures and project timeline commitments.

- PAN, TAN and GST Registration: Every business must obtain a PAN and TAN for tax compliance. GST registration is mandatory above turnover thresholds and enables GST collection on under-construction property sales and input tax credit claims. It’s also essential for project registration and vendor dealings.

- State and Local Licenses: Register under the Shops and Establishments Act for office premises. Depending on the state, obtain Professional Tax, PF and ESI registrations if employing staff. These are essential regulatory requirements before hiring, paying wages or operating legally in a state.

- Optional Registrations: MSME registration offers access to subsidies and credit benefits. In special cases, large projects may need environmental clearance from MoEFCC or FEMA/RBI approvals if foreign investment is involved. These additional registrations enhance credibility and legal compliance in specific business scenarios.

In summary, the key licenses for a real estate business are essentially its legal registrations: the company/LLP registration and RERA certificate are the core “licenses,” supplemented by tax and local authority registrations. Failing to obtain these can stop your business in its tracks – for example, without GST registration you cannot legally collect tax or provide valid invoices and without RERA you cannot sell projects exceeding the threshold.

WHY APPROVALS AND LICENSES MATTER

Strict compliance with approvals and licenses is not just bureaucratic red tape, it is essential for running a legal, credible and successful real estate business in India.

Key laws like the Real Estate (Regulation and Development) Act (RERA) were introduced to bring transparency and accountability to the sector. RERA mandates the registration of all commercial and residential projects above a specified threshold, compelling developers to disclose layouts, timelines and financials while depositing 70% of collected funds into an escrow account. This drastically reduces fraud and ensures project completion.

Traditional property laws also reinforce legal discipline. The Registration Act, 1908 requires that sale deeds and lease agreements be officially recorded, preventing title fraud. The Indian Stamp Act ensures proper stamp duty payment, making documents legally enforceable. The Indian Contract Act governs sale and lease terms, protecting the validity of transactions. These laws collectively safeguard both buyer and developer rights.

From a business standpoint, approvals and licenses reassure customers, banks and regulators that the project is compliant and secure. Banks won’t release funds without sanctioned plans or RERA approval. Authorities can halt or demolish unauthorized buildings, while buyers avoid non-compliant projects. In contrast, approved projects attract faster sales and fewer legal risks. Therefore, it is essential to engage legal and compliance professionals early to navigate approvals efficiently and avoid penalties later.

HOW LAWFINITY CAN HELP YOU ESTABLISH AND GROW YOUR REAL ESTATE BUSINESS

At Lawfinity, we recognize that real estate is more than just the bricks and mortar that underpin every community, it is a tangle of laws and regulations, calling for precision, foresight and expertise. Backed by years of expertise in compliance, licensing and legal advisory, we are dedicated to provide you full support tailored to suit developers, brokers, investors and property managers throughout India.

Here’s how we support you at every stage:

- Business Incorporation & Structuring: We help you choose the right legal entity—be it LLP, Private Limited Company or Partnership— and handle the entire incorporation process, including PAN, TAN, GST registration and MCA filings. We ensure your structure aligns with your funding goals, risk appetite and scalability.

- RERA Agent & Project Registration: From documentation to final certification, we handle RERA registration for real estate agents and developers in any state. We ensure your submissions meet the latest regulatory standards and assist with renewals and compliance audits.

- Land Title Due Diligence & Property Vetting: Our legal team performs exhaustive title checks, mutation history analysis, encumbrance verification and zoning validation to ensure the property is litigation-free and legally sound before acquisition or development.

- Drafting & Vetting of Legal Agreements: We draft and review essential documents like builder-buyer agreements, joint venture contracts, lease deeds, development agreements and MoUs — ensuring your rights are protected and disputes minimized.

- Labor Law & Construction Compliance: We assist you in registering under applicable labor laws, including BOCW and Contract Labour Acts and advise on contractor documentation, ESIC/EPF compliance and workforce welfare requirements.

- GST Registration, Advisory & Filing: Real estate taxation is complex, especially with the transition from VAT/Service Tax to GST. We help you register, manage ITC (input tax credit) and file timely GST returns aligned with sector-specific rules.

- Environmental, Fire & Zoning Approvals: Whether it’s obtaining EIA clearance, Fire NOC or zoning conversion approvals from authorities, our team manages the application process, site documentation and follow-ups to keep your project timeline on track.

- Regulatory Notices, Dispute Resolution & Litigation Support: Facing a RERA complaint? Land dispute? Notice from a municipal authority? Our litigation team handles legal notices, mediations, tribunal representation and full-scale litigation support when needed.

Whether you are:

- Launching a boutique real estate brokerage,

- Building a large-scale residential or commercial project,

- Investing in land for aggregation or leasing,

- Or entering joint ventures with builders or investors,

Lawfinity becomes your dedicated legal partner ensuring you are fully compliant with Indian property laws, RERA mandates, environmental regulations and contractual norms. We simplify the legal complexities so you can focus on growing your business confidently and sustainably.

Ready to build your real estate dream on a strong legal foundation?

Visit www.lawfinity.in or contact our team for a personalized consultation today.

Let Lawfinity be your legal backbone in India’s ever-evolving real estate sector.

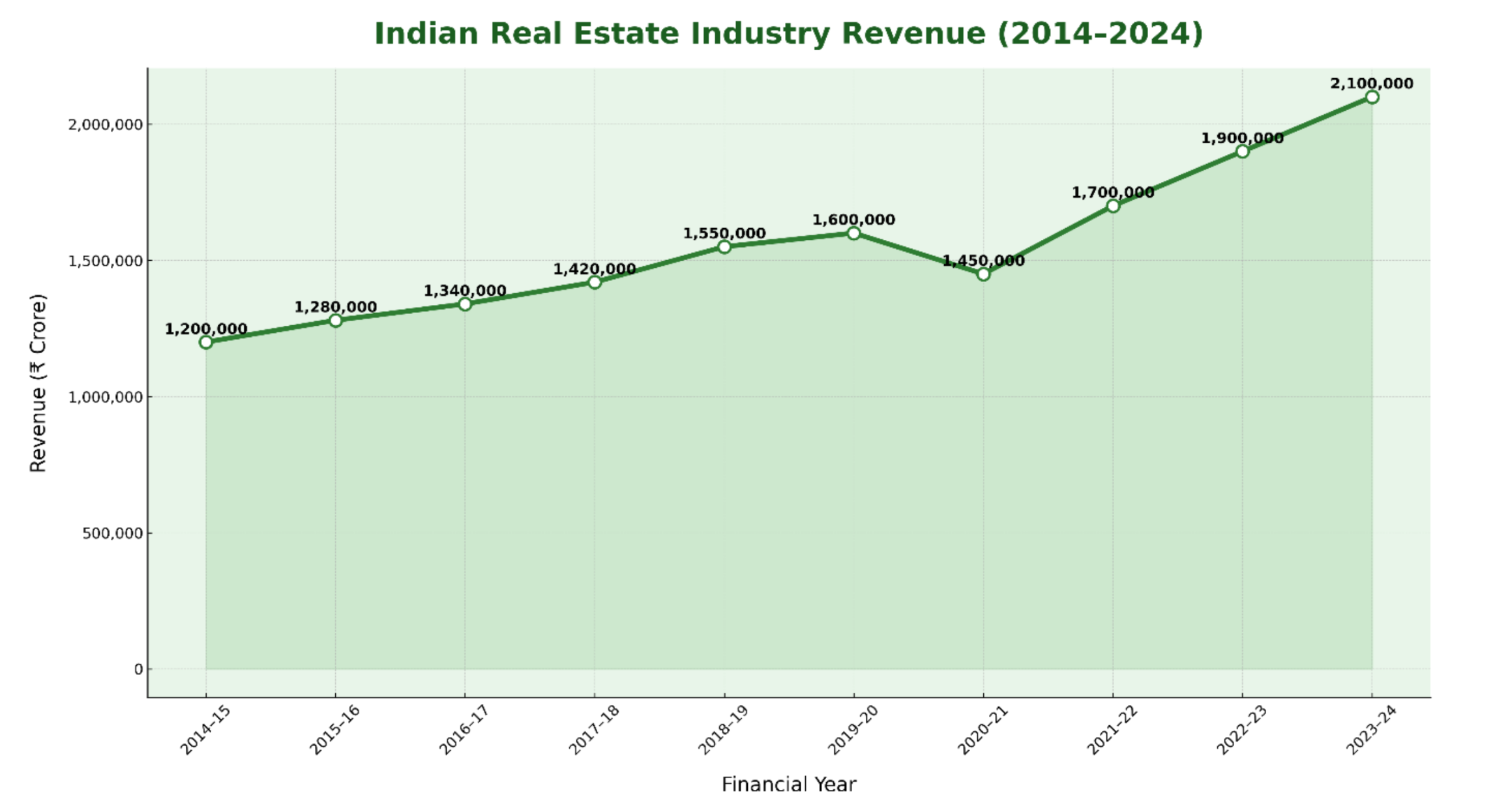

INDIAN REAL ESTATE INDUSTRY REVENUE (2014–2024)

Source: India Brand Equity Foundation (2020), Lakshmislri & CREDAI (2024 Market Report), World Bank / ResearchGate (2024) —adjusted to reflect real-world events like the 2020 COVID slowdown and post-pandemic revival)

The line graph illustrates the estimated revenue trend of the Indian real estate industry over the last 10 financial years, from FY 2014–15 to FY 2023–24.

The data reflects consolidated earnings from residential, commercial, industrial and retail real estate segments across India.

From ₹12 lakh crore in 2014–15, the industry grew steadily year-on-year, reaching ₹16 lakh crore in 2019–20. However, the financial year 2020–21 marked a temporary decline to ₹14.5 lakh crore due to the nationwide disruptions caused by the COVID-19 pandemic. This decline was primarily attributed to project delays, labour shortages, halted site operations and weakened buyer sentiment.

The sector began its recovery in 2021–22 with ₹17 lakh crore in revenue, continuing upward to ₹19 lakh crore in 2022–23 and reaching an estimated ₹21 lakh crore in 2023–24 — marking the highest-ever revenue figure for the Indian real estate market. This sharp rebound demonstrates renewed investor interest, growing housing demand, infrastructure-led policy support and increased digitization in real estate operations.

AUTHOR’S OPINION: A DECADE OF DISRUPTION, RESILIENCE AND RESURGENCE

The Past: A Market in Transition

A decade ago, India’s real estate sector was largely characterized by fragmented markets, informal practices and investor-driven speculation. While urbanization and housing demand steadily pushed revenues upward, the sector lacked structural reforms and transparency. Between FY 2014–15 and FY 2016–17, real estate developers operated with minimal regulation and customer trust was limited due to frequent delays, unclear land titles and financial mismanagement.

The introduction of the Real Estate (Regulation and Development) Act, 2016 (RERA) was a pivotal moment that reshaped the industry. RERA brought legal accountability, standardized project registration and enhanced buyer protection. Simultaneously, the Goods and Services Tax (GST) regime replaced fragmented state taxes, while demonetization in late 2016 curbed unaccounted transactions. These changes disrupted traditional models but also initiated long-overdue formalization.

By FY 2018–19, the industry had started realigning with new compliance norms and revenues touched ₹15.5 lakh crore. Regulatory clean-up made the sector more institutional, but also thinned out non-serious players. As a result, the years leading up to 2019–20 were marked by slow but quality-driven consolidation.

The Present: Rebuilding on a Stronger Foundation

The COVID-19 pandemic in 2020–21 posed an unprecedented challenge. Construction was halted, buyer decisions were postponed and migrant labour crises affected timely execution. Revenue fell for the first time in several years — a reflection of both disrupted supply chains and cautious demand.

However, this disruption also accelerated several long-term transformations. Developers embraced technology — from online bookings and virtual walkthroughs to digital payment systems. The demand profile shifted from investment-driven to end-user-driven. Consumers started preferring ready-to-move-in homes and trusted branded developers over speculative bets.

In the past three years (2021–2024), the sector has bounced back strongly, not just in numbers but in maturity. Driven by low interest rates, increased affordability, regulatory clarity and infrastructure expansion in Tier 2 and Tier 3 cities, the real estate market has regained momentum. Commercial real estate has also rebounded, with IT parks, co-working spaces and warehousing demand rising significantly due to the growth of e-commerce and hybrid work culture.

The ₹21 lakh crore milestone in FY 2023–24 reflects not just recovery, but transformation. The industry today is more compliant, digitized and professionally managed than it has ever been before.

The Future: From Cyclical to Strategic

Looking forward, the Indian real estate sector is poised for structural growth. Estimates suggest that by 2030, the industry could surpass ₹30–35 lakh crore in annual revenue, contributing nearly 13% to India’s GDP. This growth will not come from urban housing alone, but from mixed-use developments, logistics infrastructure, senior and student housing and green-certified buildings.

Several macro factors support this optimism — India’s expanding middle class, policy-led infrastructure investments, smart city initiatives and growing institutional interest from REITs, private equity and sovereign funds. The emergence of PropTech, fractional ownership platforms and digital land records will further streamline operations and expand investor participation.

However, challenges remain. Land acquisition, approval bottlenecks, high compliance costs and environmental restrictions must be navigated smartly. Developers who embrace compliance, sustainability and financial prudence will thrive. Those who fail to innovate or adapt will face marginalization in an increasingly professional market.

CONCLUSION: A MARKET REIMAGINED, READY TO LEAD

In my view, the Indian real estate industry has undergone a quiet revolution. Over the past 10 years, it has transitioned from being opaque and unregulated to becoming one of the most closely governed, tech-empowered and investment-attracting sectors in India.

What we see in the 2023–24 numbers is not just a recovery from the pandemic — it is a culmination of reforms, resilience and responsible practices. Developers are no longer just builders; they are brand custodians, ecosystem collaborators and policy stakeholders. Buyers are more informed. Authorities are more vigilant. And investors are more selective.

The next decade of Indian real estate will not be shaped by land banks or price speculation — but by trust, technology and transparency.

With the right mix of legal compliance, digital adoption and customer focus, India’s real estate industry is ready to lead — not just grow.

Frequently Asked Questions

Because every great business starts with the right answers.

Register your entity, obtain PAN/GST, secure all project-specific approvals and register under RERA before advertising or selling. Compliance ensures legal operation and access to finance and contracts.

Private Limited Companies and LLPs offer limited liability, investor access and scalability—making them ideal for real estate. Sole proprietorships lack protection and limit growth or funding opportunities.

Yes. Projects over 500 sq. m. or with 8+ units must register under RERA before marketing. Agents must also register. Selling without it invites penalties and legal action.

Secure land use clearance, sanctioned building plans, environmental consent (if applicable) and utility/fire safety NOCs. These are required to receive a Commencement Certificate and begin construction legally.

You need a Certificate of Incorporation, PAN/TAN, GST (if applicable), RERA registration and local registrations like Shops Act or Professional Tax, depending on the state.

Yes. Agents must register with state RERA authorities to operate legally, receive a RERA ID and maintain records. It acts as a formal license under current law.

An OC certifies legal, safe construction and is mandatory before possession, sale or utility connections. Without it, authorities can penalize or deny occupation rights.

Yes, for large projects. Smaller ones need Pollution Board approvals. Clearance depends on size, location and local/state rules. Always verify under current EIA and SPCB norms.

Non-compliance invites fines, demolitions, registration cancellation and lawsuits. Without approvals, banks won’t finance and buyers won’t invest. Full compliance ensures legal protection and project credibility.