Start Your Journey

Start Your Restaurant the Right Way

From FSSAI to Fire NOC — Lawfinity helps launch your food business legally and professionally.

INTRODUCTION

The restaurant industry in India is booming, making it an attractive venture for many entrepreneurs. In fact, the food service business is among the fastest-growing industries in the country, driven by urbanization and a rising middle class.

However, turning your culinary dream into a successful restaurant involves more than just a great menu and décor – it requires navigating a range of legal steps. From choosing the right business structure and registering your company to obtaining mandatory approvals and licenses, compliance with Indian laws is crucial for a smooth launch.

This guide provides a comprehensive overview of everything you need to start a restaurant in India, including business incorporation, key governmental approvals, required licenses and why these compliances are essential for your venture’s success.

CHOOSING THE RIGHT BUSINESS STRUCTURE

One of the first steps in starting a restaurant is deciding on a suitable business structure for your enterprise. Common options in India include sole proprietorship, partnership firm, Limited Liability Partnership (LLP), One Person Company (OPC) and Private Limited Company. Each structure has its own legal and financial implications:

- Sole Proprietorship or Partnership: Simple to start but lacks limited liability. Personal assets are exposed to business risks and the business may dissolve if the owner or partner exits. Not ideal for scaling.

- Limited Liability Partnership (LLP): Offers flexibility with limited liability. Great for small restaurant startups due to low compliance. No mandatory audit if turnover is below ₹40 lakh and capital under ₹25 lakh.

- One Person Company (OPC): Ideal for solo founders. Provides limited liability and separate legal identity with minimal complexity. Easier to manage than a private limited company, suited for small-scale growth.

- Private Limited Company: Best for scaling, investments and franchising. Offers limited liability, corporate status and equity ownership. Suitable for startups planning future expansion or multiple partners. Professionally preferred structure.

Which structure is best? For small, owner-operated eateries, an LLP can be a cost-effective choice due to its low compliance burden and liability protection. If you are starting solo, an OPC gives you a corporate shield with single ownership. For ambitious projects expecting high turnover or external funding, a Private Limited Company is usually the best option for credibility and expansion.

It’s advisable not to operate as an unregistered proprietorship if you plan to grow, since newer structures like LLPs and OPCs offer more safeguards and are relatively easy to incorporate in India. Whichever entity you choose, ensure you complete the necessary incorporation process (e.g. registering the company or LLP with the Ministry of Corporate Affairs, obtaining a PAN, TAN, etc.) before proceeding to operational licenses.

KEY APPROVALS REQUIRED

Before opening your doors to customers, you must secure certain approvals and clearances from various authorities. These approvals are crucial for legal compliance and safety.

Here are some key approvals needed (each is typically obtained by submitting applications with relevant documents, followed by inspections or verification):

- Fire Safety Clearance (Fire NOC): Restaurants must get a Fire NOC from the local fire department, confirming fire safety measures like extinguishers, alarms and exits are in place. Inspections are conducted before approval. Operating without it is illegal and unsafe.

- Building Plan Approval and Occupancy Certificate: If constructing or renovating, get building plan approval from municipal authorities. Your restaurant must be in a commercially zoned area. After construction, obtain a Completion/Occupancy Certificate to confirm structural and safety compliance before starting operations.

- Environmental Clearance (if applicable): Large or high-impact restaurants may need clearance from pollution authorities. If your setup includes DG sets, significant waste or large kitchens, a Certificate of Environmental Clearance may be required. Ensure proper disposal, sewage and board consent.

- Neighbour or Community NOCs: In residential or mixed-use areas, get NOCs from neighbours or associations to avoid conflicts. While not always mandatory, it helps gain smoother approvals, especially for trade licenses and ensures harmony in shared or sensitive locations.

(Note: The specific approvals can vary by state and city. Always check your local municipal rules. For example, some cities issue a composite “trade license” that covers basic health and safety approvals. Below, we detail the major licenses/registrations typically required nationwide.)

ESSENTIAL LICENSES AND REGISTRATIONS

Running a restaurant in India requires obtaining several licenses and registrations to comply with central and state laws. These licenses ensure your business meets health, safety and operational standards. Each license usually involves an application, fee and documentation and many need periodic renewal.

Here are the essential licenses required to open a restaurant in India:

- FSSAI License (Food Safety License): Mandatory for all food businesses, the FSSAI license ensures compliance with national food safety norms. Based on turnover, it may be a basic registration or state/central license. Apply via the FoSCoS portal. Display of the 14-digit license number is compulsory at the premises and on packaging.

- Health/Trade License (Municipal Authority): Issued by the local municipality, this license certifies hygiene and safety compliance for food establishments. Required before operation, it involves submitting layout, waste plans and employee health certificates. Periodic inspections may follow. Operating without it may result in penalties or closure by the civic authorities.

- Eating House License (Police Department): Mandatory for public eateries, this license is issued by the police department. It helps maintain law and order by registering places where public gatherings occur. Requires fire NOC, FSSAI license, ownership proof and CCTV declaration. Valid for a fixed term and must be renewed before expiry.

- Shop and Establishment Registration: All restaurants must register under their state’s Shops and Establishments Act. It regulates working hours, employee conditions and wages. Registration is done through the labour department, generally within 30 days of opening. Display of certificate is mandatory and it must be renewed as per local rules.

- GST Registration: If turnover exceeds ₹20 lakh (₹10 lakh in special states), GST registration is compulsory. It enables legal tax billing and business with platforms like Swiggy/Zomato. Restaurants typically charge 5% GST. Register on the GST portal using PAN, address and bank details. Return filing is required periodically.

- Liquor License (if serving alcohol): Required to serve alcohol, this license is granted by the state excise department. Application involves trade license, fire and police NOC, business proof and location compliance. It’s costly and location-restricted. Without this license, serving liquor is illegal and could lead to heavy penalties or cancellation of operations.

- Music License: Restaurants playing recorded music must get a music license from PPL/IPRS. It legalizes public performance of copyrighted music. Fees vary based on usage and space size. Playing music without it invites copyright issues or fines. Apply by submitting business details and paying the required royalty fees annually.

- Signage License: Required for outdoor advertising like boards or hoardings, this license is issued by municipal authorities. You must provide signage size, design and location for approval. Annual fee applies. Unauthorized signage can lead to fines or removal. Always get this once your branding is ready for public display.

Other Permits (as needed): Depending on the nature of your restaurant, there may be additional licenses:

- Lift Clearance: Mandatory for elevators in multi-story restaurants. Requires inspection by the Electrical Inspector and permit from the labour department for safe use.

- PESO License: Needed if storing large quantities of LPG or diesel. Ensures safe fuel storage as per Petroleum and Explosives Safety Organization norms.

- Waste Disposal Permits: Large restaurants may need municipal approval or tie-up for food waste disposal if waste exceeds set local limits.

- Food Delivery Compliance: Cloud kitchens need FSSAI, trade license and GST. Food apps require valid FSSAI number and proper hygiene documentation for listing.

- Trademark Registration: Protect your brand legally by registering your restaurant’s name or logo—especially if planning expansion or future franchising.

Ensure all these licenses are obtained before your grand opening. Most licenses (FSSAI, trade, GST, etc.) should be in place or at least applied for, so you can operate without legal hurdles.

Remember that licenses like FSSAI and GST require displaying your registration details at the premises (e.g., FSSAI certificate in the kitchen or entrance, GSTIN on invoices) and some like the fire NOC and trade license should be readily available for inspection.

Keep a calendar for renewals – many licenses need annual or periodic renewal (FSSAI is renewable, health licenses often annually, liquor licenses yearly, etc.) and missing a renewal can be as problematic as not having the license at all.

WHY APPROVALS AND LICENSES ARE NEEDED

Obtaining the myriad approvals and licenses might seem cumbersome, but they are in place to protect your business and the public. Here’s why these compliances are necessary and beneficial:

- Legal Compliance and Avoiding Penalties: Operating without licenses can lead to fines, shutdowns or legal action. Compliance keeps your restaurant legally safe and prevents costly interruptions, such as trade license-related closures or criminal charges for unauthorized liquor sales.

- Safety and Health Assurance: Licenses like FSSAI, health clearance and fire NOC ensure your restaurant meets hygiene and safety standards. These approvals protect customers and staff, reduce risks of foodborne illnesses or accidents and confirm emergency preparedness.

- Protecting Your Business and Liability: Proper licensing shields you from liability and safeguards personal assets. In legal issues or customer complaints, having licenses shows due diligence and helps prove that you operated responsibly and in compliance with all business regulations.

- Building Customer Trust and Brand Image: Visible licenses boost customer confidence and show professionalism. FSSAI or liquor permits signal safe, law-abiding service. This attracts loyal customers and builds your brand’s reputation, unlike unlicensed outlets that may appear risky or untrustworthy.

- Access to Services and Expansion Opportunities: Licenses enable you to access B2B services, food platforms, bulk supplies and financial support. They’re essential for partnerships, bank loans, franchising or government schemes. Compliance ensures smooth operations and opens doors for long-term growth.

But we don’t stop at just licensing. Lawfinity also assists in:

HOW LAWFINITY CAN HELP YOU IN ESTABLISHING YOUR DESIRED BUSINESS

At Lawfinity, we know from experience that opening a restaurant isn’t just about choosing the right location or having a killer menu — it is the legal stuff that often turns into a headache. Licences, registrations, approvals, it piles up quickly. And if you are not careful, one missed document or delay from a government office can throw your whole launch off track. That’s exactly where we come in. Our role is to handle all of that for you so you don’t get stuck in red tape before you even open your doors.

Whether you are an aspiring entrepreneur setting up your first QSR outlet or a seasoned restaurateur expanding into a new city with a fine-dining concept — we are here to walk with you from start to finish. We take care of your business setup — be it LLP, OPC or Private Limited — and help you reserve the name, file the forms and move quickly through the system. On top of that, we handle all the core licences: FSSAI Registration (a must for food), Fire NOC, Shop & Establishment Registration, Health Trade Licence, Eating House Licence, GST Registration and anything else that might be needed depending on where you are opening.

We have worked across India — especially in metro cities like Delhi, Mumbai, Bengaluru — and we know how different departments function. Let’s be honest: rules on paper and rules in practice are not always the same. That’s why our team gets directly in touch with FSSAI officers, fire departments, municipal corporations, excise authorities, labour offices — basically whoever’s involved — and follows up till things move. We don’t just “apply and wait”; we push things forward so you can focus on getting your kitchen ready, hiring staff, planning your launch — the real work of building your restaurant.

But we don’t stop at just licensing. Lawfinity also assists in:

- Drafting vendor, employment and franchise agreements

- Handling employee registration under PF, ESI and Professional Tax

- Managing your post-launch compliance calendar (renewals, filings, audits)

- Advising on IP protection for your brand, logos or recipes through Trademark Registration

- Ensuring you stay compliant with labour laws, environmental regulations and taxation

Legal compliance should empower your business — not slow it down. Our mission is to make regulatory matters effortless for you, so you can focus on what you do best: building an unforgettable food brand.

Reach out to Lawfinity today

Visit us at www.lawfinity.in to schedule a free consultation or get started with your restaurant registration package.

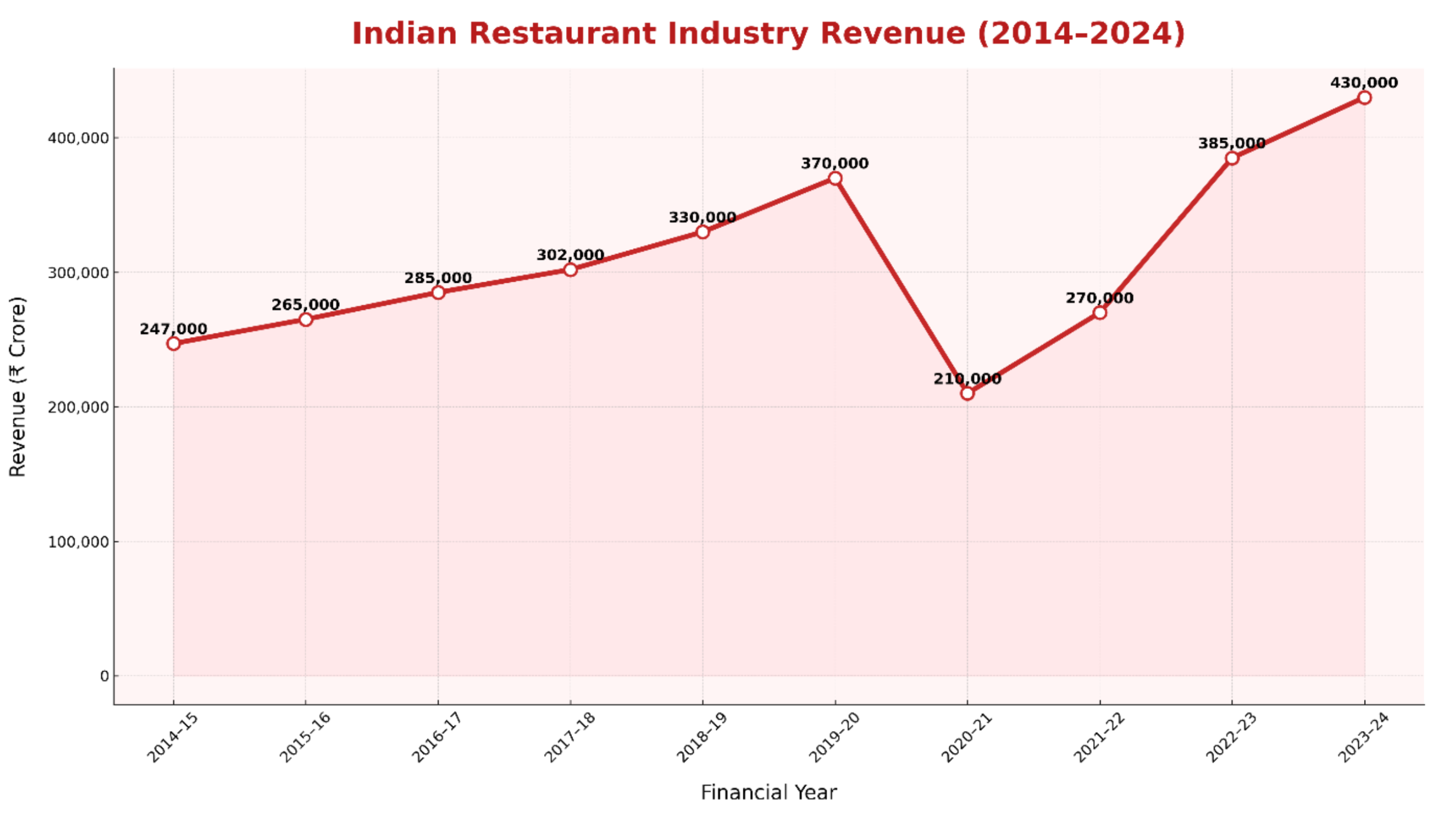

INDIAN RESTAURANT INDUSTRY REVENUE (2014–2024)

Source: National Restaurant Association of India reports, FICCI–Technopak industry studies and news analyses (Business Standard, Times of India) for pandemic impact)

The industry saw consistent growth from ₹2.47 lakh crore in 2014–15 to ₹3.7 lakh crore in 2019–20.

A steep dip in 2020–21 to ₹2.1 lakh crore occurred due to the COVID-19 pandemic, lockdowns and dine-in restrictions.

From 2021–22 onwards, there's a strong recovery curve, reaching ₹4.3 lakh crore in 2023–24 — the highest ever.

AUTHOR’S OPINION: PAST, PRESENT & FUTURE OF INDIAN RESTAURANT INDUSTRY

The Past: A Decade of Growth with Structural Shifts

From 2014–2019, India’s restaurant industry underwent a transformation. Urbanization, rising disposable income and changing lifestyles led to an explosion in casual dining, quick service restaurants (QSRs), food delivery apps and cafés.

Brands like Zomato, Swiggy, Domino’s and Haldiram's capitalized on the rising demand from tech-savvy, convenience-driven consumers. During this period, cloud kitchens also emerged as an agile model with low overheads.

By 2019–20, the industry touched ₹3.7 lakh crore, marking a robust growth era.

The Present: Resilience and Rebound Post-COVID

The COVID-19 pandemic disrupted the industry like never before. In 2020–21, revenues plummeted to ₹2.1 lakh crore, reflecting closures, job losses and consumer hesitation.

However, the industry responded dynamically:

- Restaurants shifted to cloud kitchens, delivery-only models and digital menus.

- The rise of contactless dining, QR ordering and loyalty apps helped retain customers.

- Government initiatives under Startup India and PM SVANidhi gave MSMEs a slight boost.

By 2023–24, revenue surged to ₹4.3 lakh crore, proving that the sector is not just recovering, but evolving.

The Future: Expansion, Innovation & Tier-II Growth

The future of the restaurant industry in India is extremely promising, driven by these trends:

- Tier II & III Boom: Brands are expanding into smaller cities due to saturation in metros. Consumer habits are becoming more uniform across regions.

- Digital-First Operations: POS systems, inventory analytics and AI-driven demand forecasting will be essential for efficiency.

- Health, Sustainability & Fusion: Rise in demand for healthy, plant-based organic and fusion cuisine will push restaurants to innovate menus.

- Policy Push: Easier licensing, GST simplification and food safety standardization (via FSSAI) will encourage organized players to expand.

CONCLUSION: REINVENTION IS THE NEW RESILIENCE

In my view, the Indian restaurant industry has emerged stronger after facing its toughest challenge in recent history. From dine-in dependency to digital-first adaptability, this journey reflects entrepreneurial spirit, customer loyalty and operational reinvention.

The data clearly shows that not only has the industry recovered, but it is poised to cross ₹5 lakh crore in the near future — provided it continues to innovate, invest in safety and decentralize operations.

The last 10 years were about expansion. The next 10 will be about sustainability, technology and smart growth.

Frequently Asked Questions

Because every great business starts with the right answers.

You will need FSSAI, trade/health license, eating house license, fire NOC, shop registration, GST and possibly liquor, music, signage and environmental permits.

Yes, FSSAI is mandatory for all food businesses. It proves your food meets safety standards and protects you from legal trouble or closure.

LLP or Private Limited Company offers better liability protection, branding and growth potential compared to proprietorship or partnership. Choose based on your future plans.

GST registration is required above ₹20 lakh turnover. Restaurants usually charge 5% GST, while alcohol is taxed separately under state excise rules.

Apply to your state excise department with required documents, NOCs, fees. Conditions vary by state—distance limits, hours and legal age apply.

Trade license is from the local body for operating; FSSAI is central for food safety. Both are mandatory and serve different regulatory purposes.

The cost varies depending on your city and the scale of your restaurant. Some costs to consider: FSSAI License: Basic registration starts at ₹100/year. State licenses cost ₹2,000 and Central ones ₹7,500. Agents may charge extra for application assistance. Trade License: Fee depends on city and size. Small eateries pay around ₹5,000/year; larger restaurants in metros may pay much more depending on seating capacity. Liquor License: Liquor licenses are costly—₹5–15 lakh/year depending on state, type and city. Temporary permits are cheaper, but full-year bar licenses are heavy investments. GST Registration: GST registration is free online, but you will likely pay professionals to handle monthly or quarterly filings, depending on your business structure and turnover. Eating House & Other Licenses: Fees are moderate. Eating house, Fire NOC and others may cost a few thousand each. Music licenses vary, averaging ₹10,000 annually for small setups. Overall Cost (No Alcohol): For a small restaurant without liquor, total license fees may range ₹10,000–₹30,000. It includes FSSAI, trade license, fire NOC and basic registrations. Overall Cost (With Liquor): Add a liquor license and total cost can cross ₹5–15 lakh. Always check latest local fee structures for exact costs in your location.

The timeline can range from a few days to a few months, depending on the license: FSSAI License: Basic registration takes 7–10 days; State or Central license with inspections may take up to 30 days if documents and setup are all correct. Trade/Health License: Usually issued in 15–30 days after fulfilling prerequisites. Timelines may vary depending on your city’s rules and whether online single-window systems are available. Eating House License: Takes around 45–60 days due to police verification. Apply early, as this is often one of the slowest approvals during the restaurant setup. Fire Safety NOC: If setup meets safety norms, NOC may come in 1–2 weeks post-inspection. Delays happen if fire safety equipment needs upgrading or reinstallation. Liquor License: Highly variable—can take 1–6 months depending on state, quota and scrutiny. Apply well in advance if your restaurant plans to serve alcohol. GST Registration: Generally quick—issued within 3–7 days online unless flagged for verification. Make sure PAN and business details are clear to avoid delays. Shop & Establishment: Usually takes 1–2 weeks. It’s mostly a procedural step, but mandatory for compliance with labour laws and record-keeping at state level.

Running a restaurant without licenses risks fines, closure, arrests and denied insurance claims. Skipping approvals may save time short-term but invites legal, financial and safety issues that could destroy your business entirely. It's not worth it.