Start Your Journey

Start Your Social Welfare (NGO) the Right Way

Lawfinity helps you with Trust/Society/Section 8 setup, 12A & 80G, CSR-1, FCRA, NGO Darpan and all registrations — with expert support and zero hassle.

INTRODUCTION

The social welfare industry in India refers to the broad non-profit sector comprising charities, non-governmental organizations (NGOs), foundations and other entities devoted to social causes. India has a vibrant social sector – by some estimates there were over 3.3 million NGOs registered in India as of 2009, roughly one for every 400 citizens. These organizations play a crucial role in areas like education, healthcare, poverty alleviation and community development, often filling gaps in government services. Starting a social welfare organization (essentially a charitable or non-profit entity) requires navigating a complex legal framework to ensure your venture is properly registered and compliant with all laws. In India, NGOs are typically structured as public charitable trusts,societies or Section 8 companies, each governed by different laws. In this comprehensive guide, we will explain everything you need to know – from choosing the appropriate business structure to obtaining necessary approvals and licenses – to start a social welfare organization in India. We will also discuss why these approvals are needed, how a professional firm like Lawfinity can assist you and answer frequently asked questions so that you have a clear roadmap for launching your charitable venture.

TYPES OF BUSINESS ENTITIES IN THE SOCIAL WELFARE SECTOR

When starting a non-profit in India, choose from Trusts, Societies or Section 8 Companies, each with unique benefits based on your mission, scale and compliance needs for social welfare goals. Below, we outline these structures and advise on which may be best suited for a social welfare enterprise:

- Public Charitable Trust: A trust involves a settlor transferring assets to trustees for public benefit, governed by the Indian Trusts Act or state laws. Easy to set up, flexible and suited for small initiatives. However, it lacks strict regulation and democratic governance, with limited transparency and difficulty in modifying or dissolving the trust.

- Society (Non-Profit Society): A society is a democratic, membership-based entity formed for charitable or public purposes under the Societies Registration Act, 1860. It suits collaborative projects, offers legal identity and allows flexibility. But it needs at least seven members, involves more compliance and internal disputes may arise due to its democratic structure.

- Section 8 Company (Non-Profit Company): A Section 8 Company is a not-for-profit corporate entity under the Companies Act, ideal for scalable NGOs seeking credibility and funding. It offers legal identity, limited liability and tax benefits. However, setup is complex and strict regulatory compliance makes professional help essential for ongoing operations and governance requirements.

Which structure is best? The ideal structure depends on your initiative’s size and goals. For small, local or family-run charities, a Trust is the simplest and easiest to manage. If you value democratic governance and community participation, a Society is suitable. However, for larger NGOs, growth plans or significant fundraising (including CSR or foreign funds), a Section 8 Company is generally preferred due to its strong governance, credibility and appeal to donors. Many established NGOs in India choose this form. Regardless of structure, all are legally non-profit—profits cannot be distributed and must be used to fulfill charitable aims. Choose based on your project’s scale, compliance readiness and long-term vision for social impact and operational management.

NECESSARY APPROVALS FOR STARTING A SOCIAL WELFARE ORGANIZATION

Once you have decided on the type of entity (Trust, Society or Section 8 Company), the next step is to obtain certain government approvals and registrations that are necessary to legally establish and operate your organization. These approvals grant your NGO legal recognition and enable it to avail various benefits (like tax exemptions and eligibility for funding). Here are the key approvals typically required, each explained in brief:

- Entity Registration Approval: This is the foundational step to legally establish your NGO—via a Trust deed (Trust), Memorandum & Bye-laws (Society) or MCA SPICe+ form with license (Section 8 Company). It grants legal recognition and enables your organization to operate as a registered non-profit under Indian law.

- Permanent Account Number (PAN) Approval: After registration, apply for a PAN in your NGO’s name. PAN is essential for taxation, banking and financial operations. It's mandatory even for tax-exempt NGOs and is often integrated with Section 8 incorporation or done separately for Trusts and Societies through the Income Tax Department’s online platform.

- Tax-Exemption Registration (Section 12A of Income Tax Act): Register under Section 12A/12AB to exempt your NGO’s income from tax. It applies to Trusts, Societies and Section 8 Companies. Without 12A, donations and grants may be taxed. It’s also a prerequisite for various benefits, including receiving government or international funds for charitable activities.

- Donor Tax Benefit Approval (Section 80G Certificate): An 80G certificate allows your donors to claim tax deductions on contributions made to your NGO. It boosts fundraising and credibility by offering financial incentives to donors. Granted by the Income Tax Department, it’s optional but highly recommended to attract corporate and individual support.

- CSR Registration (Form CSR-1): To receive corporate CSR funds, NGOs must file Form CSR-1 with MCA and obtain a Unique CSR Registration Number. It's mandatory for CSR eligibility and requires your NGO’s registration, PAN, 12A/80G details and certification by a CA or CS. This opens the door to corporate partnerships.

- NGO Darpan Registration (NITI Aayog Portal): Registering on the NGO Darpan portal gives your NGO a unique ID required for many government grants and schemes. Though optional, it’s crucial for credibility and accessing public funding. The process involves submitting organizational and activity details, enhancing visibility with ministries and funding agencies.

These approvals establish your NGO’s legal identity and operational readiness. Based on your goals, you may need some or all—entity registration, 12A for tax exemption, 80G for donor benefits, CSR-1 for corporate funding and NGO Darpan ID for government schemes. Next, we’ll cover additional licenses for specific activities.

REQUIRED LICENSES AND REGISTRATIONS

In addition to the basic approvals above, certain licenses/registrations are legally required or advisable for social welfare organizations in specific scenarios. Below are the key licenses and certifications you should be aware of:

- Section 8 Company License (Central Government License): As part of forming a Section 8 Company, you must obtain a Central Government license via the MCA portal. This license authorizes non-profit operations and exempts the use of “Pvt Ltd/Ltd” in the name. It confirms your organization’s charitable purpose and prohibits profit distribution to members or shareholders.

- Foreign Contribution Regulation Act (FCRA) License: To legally accept foreign donations, NGOs must obtain FCRA registration from the Ministry of Home Affairs. Typically granted after 3 years of operation, it ensures foreign funds are used appropriately. Prior-permission can be sought earlier for specific donations. Annual reporting is mandatory to maintain compliance and transparency.

- State-Specific Operating Licenses: Depending on your NGO’s activities, you may need licenses from relevant state departments—e.g., health department for clinics, education boards for schools or child welfare departments for orphanages. These are not for NGO registration but for operating sector-specific services. Compliance ensures lawful functioning of your social service programs.

- Local Business Licenses & Labor Registrations: NGOs must comply with general business laws like Shop and Establishment registration for offices. Labor-related registrations like EPF, ESI and professional tax may be required depending on employee count. These ensure legal operations and protect employee rights, similar to any organization employing staff or maintaining physical offices.

- Other Voluntary Certifications: While not mandatory, optional credentials like ISO certification or registration with relevant government schemes (e.g., National Trust for disability NGOs) can boost your NGO’s credibility. Though not mandatory, such recognitions demonstrate transparency, professionalism and help build trust with donors, grant agencies and regulatory bodies for future funding and collaborations.

Beyond basic registrations, obtain an FCRA license for foreign funding and any sector-specific permits for your services. Also, follow general business laws like local and labor registrations. Staying compliant ensures your NGO operates legally, grows smoothly and maintains credibility with stakeholders.

WHY ARE THESE APPROVALS AND LICENSES NEEDED

Setting up a social welfare organization isn’t just about paperwork for its own sake – each approval or license serves an important purpose in ensuring your NGO can operate effectively, transparently and in accordance with the law. Here’s why obtaining these approvals/licenses is necessary:

- Legal Recognition and Trust: Registering your NGO gives it a separate legal identity, enabling asset ownership, contracts and hiring in its name. It ensures continuity, limits personal liability (especially in Section 8) and builds trust among donors and authorities, showing the organization is officially recognized and professionally structured.

- Tax Exemptions and Financial Viability: 12A registration exempts your NGO’s income from tax, while 80G encourages donations by offering tax benefits to donors. These approvals are essential for financial sustainability and often mandatory for receiving grants, showing compliance and enhancing your ability to retain and attract funds for charitable work.

- Access to Funding (CSR and Foreign Contributions): CSR-1 is required to receive corporate CSR funds and FCRA allows legal foreign donations. Both approvals expand funding options and validate your NGO’s credibility. They ensure compliance with donor regulations and position your organization for large-scale, transparent and sustainable fundraising, both domestically and internationally.

- Regulatory Compliance and Oversight: Approvals like 12A, 80G and FCRA enforce financial discipline and transparency. They require proper accounting and reporting, preventing misuse of funds. Regulatory oversight protects public trust and ensures NGOs stay aligned with their stated objectives, promoting responsible operations and ethical governance in the social sector.

- Enhanced Credibility and Opportunities: Additional registrations like NGO Darpan, CSR-1 and ISO boost your NGO’s reputation. They demonstrate transparency, readiness for collaboration and compliance with standards, attracting donors, government partners and volunteers. These certifications differentiate serious NGOs from unregistered entities, unlocking new funding, visibility and long-term opportunities.

Approvals and licenses are vital for legal operation, financial benefits and building trust. Missing mandatory ones like FCRA can lead to penalties, while skipping optional ones like 80G or CSR-1 can limit funding. Though bureaucratic, these steps strengthen your NGO. Stay updated with compliance, as laws evolve and new requirements may emerge over time.

HOW LAWFINTY CAN HELP YOU ESTABLISH YOUR SOCIAL VENTURE

Starting an NGO and navigating the myriads of legal requirements can be challenging – this is where Lawfinity comes in as your trusted partner. Lawfinity is a professional services firm that specializes in business compliance, licensing and legal services in India, with a dedicated focus on helping entrepreneurs and organizations from incorporation through ongoing compliance. When it comes to setting up a social welfare business (non-profit), Lawfinity offers end-to-end assistance at every stage:

- Choosing the Right Structure: Lawfinity guides you in selecting the most suitable legal form—Trust, Society or Section 8 Company—based on your NGO’s mission and goals. Their experts explain each option clearly, helping you make an informed decision aligned with your long-term vision, legal needs and operational strategy, ensuring a solid foundation for your non-profit.

- Seamless Incorporation/Registration: Lawfinity manages end-to-end NGO registration, from drafting Trust Deeds or Society Memorandums to filing Section 8 incorporation forms, obtaining DSCs and DINs and coordinating with government authorities. Their professional handling ensures accuracy, saves time and guarantees compliance, letting you focus on launching your initiatives rather than navigating complex paperwork.

- Securing Approvals & Licenses: Lawfinity handles all key approvals—12A, 80G, FCRA, CSR-1, NGO Darpan—and supports PAN, bank account setup and special licenses. Their team ensures error-free documentation and timely filings, helping you unlock tax exemptions, donor benefits and major funding sources with minimal hassle, while ensuring full compliance with legal and regulatory standards.

- Ongoing Compliance and Advisory: Lawfinity offers long-term compliance support—filing annual returns, renewing 80G/FCRA, updating records and advising on best practices. They proactively manage deadlines and filings, minimizing risks of non-compliance. Their advisory ensures smooth operations and legal accuracy, letting your NGO run confidently and focus on creating social impact without regulatory worries.

- Expertise in the Social Sector: With deep knowledge of NGO laws and compassion for social causes, Lawfinity offers practical, people-focused legal support. Whether you're navigating FCRA accounts, adapting to new laws or facing operational challenges, they provide clear, tailored guidance—positioning themselves as committed partners in your non-profit’s growth and long-term success.

In summary, Lawfinity can simplify your journey of establishing a social welfare organization by handling the heavy lifting of legal formalities. From “incorporation to strategic advisory,” Lawfinity simplifies your entire business (and non-profit) journey across India. With their support, you can ensure that your dream of making a social impact is built on a solid legal foundation and that your NGO remains compliant and eligible for all the benefits it deserves. By entrusting the regulatory complexities to Lawfinity, you can focus on what truly matters – the mission of your organization and the communities you aim to serve.

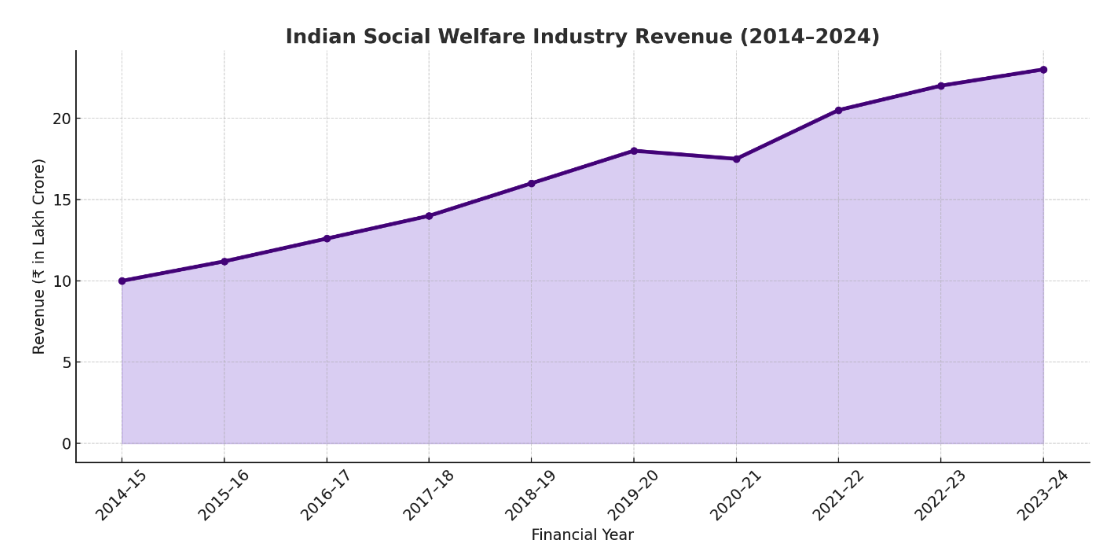

INDIAN SOCIAL WELFARE INDUSTRY REVENUE (2014–2024)

Source: (Source: Bain & Company – India Philanthropy Report 2024, Economic Survey / MOSPI Social Protection Data and Times of India / CSR Growth Projections)

This line graph presents the evolution of India’s Social Welfare Industry revenue over the last decade, rising from ₹10 lakh crore in FY 2014–15 to ₹23 lakh crore in FY 2023–24. This includes government welfare schemes, social security, healthcare, education initiatives, public subsidies and CSR funding from private stakeholders.

AUTHOR’S OPINION: WELFARE AS THE FOUNDATION OF EQUITABLE GROWTH

The Past: Building a Safety Net (2014–2020)

India’s welfare journey since 2014 has been marked by systemic reform and scale. Flagship programs such as Jan Dhan Yojana, PM Kisan, Ayushman Bharat and Swachh Bharat Abhiyanexpanded the government’s welfare footprint to the remotest parts of India.

From ₹10 lakh crore in 2014 to ₹18 lakh crore in 2020, this era saw increased budgetary allocations, creation of direct benefit transfer platforms and public-private cooperation through CSR and NGOs. While challenges remained—such as leakages and bureaucracy—India was laying the foundation for a digitally monitored, outcome-oriented social delivery system.

The Present: Crisis Response and Institutional Strengthening

The COVID-19 pandemic was a defining moment. In FY 2020–21, welfare spending briefly contracted, but was soon redirected toward urgent needs like food security, healthcare subsidies, job loss compensation and vaccine rollouts.

This pushed the industry back on a growth path—reaching ₹23 lakh crore by FY 2023–24. Importantly, private sector participation grew sharply during this time. CSR spendings rose, new philanthropic models emerged (like ACT Grants) and tech-enabled NGOs expanded operations.

The welfare landscape today is powered by UPI-based DBTs, Aadhaar linkages and predictive analytics for targeting the right beneficiaries. India now has one of the largest welfare delivery ecosystems globally, with speed, scale and transparency.

The Future: From Access to Empowerment

Looking forward, the Indian social welfare industry is expected to grow at a CAGR of 8–10%, potentially reaching ₹30–32 lakh crore by FY 2026–27. But the narrative will shift—from access to empowerment.

We are likely to see:

- More conditional cash transfers linked to nutrition, learning or health goals.

- Expansion of universal social protection, especially for gig and informal workers.

- Integration of mental health, skilling and elder care into mainstream welfare agendas.

- Increasing green and climate-resilient welfare (e.g. clean water, solar electrification).

- A rise in digital-first welfare tech startups solving for last-mile access.

Additionally, AI-driven beneficiary profiling, community-based impact measurement and CSR 2.0 models will further modernize the sector.

CONCLUSION: WELFARE IS NOT CHARITY—IT’S STRATEGY

India’s social welfare industry has transitioned from being a reactive tool to poverty into a proactive investment in the country’s future. The increase in welfare expenditure from ₹10 lakh crore to ₹23 lakh crore is not just a budgetary jump—it’s a sign of a deeper transformation. This shift shows that the nation is prioritizing inclusion, dignity and opportunity for all, especially for its most vulnerable citizens.

With social reform now moving in tandem with economic reform, welfare has become a catalyst for growth rather than a cost. Programs like child nutrition, skill training and financial access for rural women are laying the groundwork for a more productive, resilient society. Each rupee spent isn’t an expense—it’s a down payment on national strength.

In today’s India, welfare isn’t a political afterthought or optional expense. It’s a core pillar of development strategy—essential for building a just, sustainable and truly empowered nation.

Frequently Asked Questions

Because every great mission starts with the right answers.

Section 8 Company offers strong credibility and growth potential. Trusts suit small, close-knit setups; Societies fit democratic groups. All are non-profit—choose based on size, funding plans and governance needs.

It depends on the form of the NGO. Trust: minimum 2 people; Society: 7 members; Section 8 Company: 2 directors/shareholders (often same individuals). Choose based on how many committed people you have at the start.

Not mandatory, but highly recommended. Unregistered groups lack legal status, can’t raise formal funds or sign contracts. Registering boosts credibility, enables fundraising and protects founders legally.

Obtain DSCs, apply for name approval, draft MOA/AOA, file SPICe+ forms and get incorporation via MCA. Includes PAN/TAN. Requires detailed documents—often done with professional help.

12A exempts NGO income from tax; 80G gives tax benefits to donors. Not mandatory, but crucial for fundraising and saving on taxes. Apply soon after registration for maximum advantage.

You must register under FCRA or get prior permission. Requires 3 years’ activity and ₹10 lakh spent. Open a designated SBI account and follow strict compliance for foreign funds.

CSR funds come from companies fulfilling their legal obligation. NGOs must register via CSR-1, be 3+ years old and show good compliance (12A, 80G) to qualify as implementing partners.

Yes. NGOs can earn income and pay reasonable salaries if profits are reinvested in charitable work. Transparency is key—no personal gain allowed. Keep clear records to avoid scrutiny.

File annual tax returns, renew 12A/80G and FCRA every 5 years, update NGO Darpan/CSR details and follow labor/tax laws. Section 8 companies also file MCA returns and hold AGMs.