Start Your Journey

Transforming Waste into Opportunity: The Rise of India’s Clean Business Revolution

From local collection to cutting-edge recycling and energy recovery, this sector is redefining how the nation manages its waste—cleanly, legally, and profitably.

INTRODUCTION

Waste management is a critical and growing sector in India, driven by rapid urbanization and industrialization. Recent data shows India generates over 62 million tons of waste annually, highlighting an urgent need for efficient recycling, treatment and disposal solutions. The government’s Swachh Bharat initiatives and stricter environmental laws have increased demand for professional waste services. A successful waste management enterprise can include services such as collection, segregation, composting, recycling or energy recovery. To start such a business, entrepreneurs must carefully plan everything from the legal business structure to the required environmental approvals and licenses under Indian law. This guide covers each step – from company incorporation to compliance – so you understand exactly what it takes to enter the waste management industry in India.

Modern waste management emphasizes segregation and resource recovery. In practice, this means setting up collection systems for biodegradable (like kitchen scraps) and non-biodegradable waste (like plastics and metals) at the source. Establishing a waste business often involves building or securing a treatment facility (for composting, recycling, etc.) and coordinating with local municipalities, industry clients or housing societies for waste pickup. Throughout this process, strict regulatory oversight from bodies like the Central and State Pollution Control Boards ensures waste is handled in an environmentally sound way. Understanding these rules and getting the right approvals at each stage – for example, consent from pollution boards and environmental clearances – is essential for operating legally and sustainably.

TYPE OF BUSINESS STRUCTURE FOR A WASTE MANAGEMENT BUSINESS

Choosing the right business structure is one of the most important legal decisions you’ll make before starting your waste management venture. It affects how you obtain licenses, raise capital, manage liabilities, and operate within regulatory frameworks. In India, the most common options are Sole Proprietorship, Partnership, Limited Liability Partnership (LLP), and Private Limited Company.

Sole Proprietorship or Partnership: These structures are simple and low-cost but offer no liability protection. Given the compliance-heavy and risk-sensitive nature of waste management, they’re suitable only for very small, local operations with minimal regulatory exposure or capital requirements.

Limited Liability Partnership (LLP): LLPs offer limited liability with lighter compliance, making them ideal for mid-sized operations like recycling or composting. However, they face hurdles in fundraising, scaling operations, and qualifying for large municipal or institutional contracts compared to more formal structures.

Private Limited Company: Best suited for large or regulated waste businesses, this structure offers strong legal credibility, limited liability, and investor access. It’s preferred for securing Pollution NOCs, EPR compliance, and government contracts, especially for projects involving infrastructure or public partnerships.

What We Recommend: While LLPs can work for smaller recycling or service-based operations, if your business model involves regulatory interaction, capital investment, or infrastructure development, a Private Limited Company is best suited for the waste management industry.

Once you finalize your structure, the next step is to register it with the Ministry of Corporate Affairs (MCA) and obtain your Certificate of Incorporation, PAN, GST, and other statutory registrations before applying for necessary industry approvals.

NECESSARY APPROVALS

Starting waste management operations requires several statutory approvals, mainly to protect air, water and public health. Key approvals include:

- Consent from Pollution Control Boards: Businesses must obtain Consent to Establish and Consent to Operate from the State Pollution Control Board before beginning operations. These approvals, required under environmental laws, verify pollution control measures and are legally mandatory to start and continue facility operations.

- Environmental Clearance (EC): Large or high-impact waste projects may require prior Environmental Clearance under EIA norms. This involves an impact assessment, public consultation, and expert review. Skipping EC—if applicable—can halt the project or lead to regulatory penalties and enforcement actions.

- Fire Safety and Building Approvals: Facilities must obtain sanctioned building plan approval and Fire NOC from relevant authorities. These ensure the structure meets safety, fire control, and evacuation standards—critical for industrial sites handling combustible, flammable, or hazardous waste materials.

- Municipal/Trade License: Every commercial waste unit must obtain a Trade or Factory License from the local municipal body. This certifies that your business is allowed to operate in the area and is formally recognized under local trade or commercial establishment laws.

- Transportation Permits: Vehicles used for transporting general or hazardous waste must comply with transport laws and hold appropriate permits. This includes Commercial Vehicle or Green Permits, and, for regulated waste types, may involve additional licensing from the Pollution Control Board.

WHY APPROVALS AND LICENSES ARE REQUIRED

Obtaining these permits is not optional – they exist to protect people and the planet. Modern environmental laws in India (like the Solid Waste, Plastic, E-Waste, and Hazardous Waste Rules) mandate that businesses manage waste responsibly. For example, the Solid Waste Rules explicitly require all generators to segregate and process waste in an eco-friendly manner. Non-compliance can lead to severe consequences. In practice, courts and regulators have imposed fines for mishandling waste, and penalties can run into tens of thousands of rupees per violation.

Beyond legal compulsion, these approvals promote sustainability. Proper waste management reduces landfilling and pollution. As one expert source notes, businesses that follow waste regulations “contribute to a cleaner environment by ensuring waste is segregated, treated, recycled, or disposed of safely”. This aligns with global and national goals to minimize landfill use and protect ecosystems. Companies that secure all consents also demonstrate corporate responsibility – customers and the community are more trusting of firms seen as eco-conscious.

In short, permits serve both as proof of compliance and as public commitment to safety. Getting them “shows the unit’s commitment to responsible, sustainable operations”. More importantly, having the right approvals avoids business risk: operating without consent can result in shutdowns, seizures or lawsuits. Thus entrepreneurs in the waste sector view these licenses as essential steps – not red tape – that enable lawful, safe business growth.

HOW LAWFINITY INDIA CAN HELP YOU SET UP YOUR WASTE MANAGEMENT BUSINESS

Starting a waste management business in India involves navigating a dense web of legal, environmental, and municipal compliances. And that’s where Lawfinity India comes in—not just as a consultancy, but as your long-term legal and compliance partner.

We understand that when you’re trying to build something meaningful—be it a recycling plant, e-waste collection facility, or even a composting unit—the last thing you want is to get stuck in government paperwork. That’s why at Lawfinity, we simplify the legal journey from start to finish.

Business Incorporation & Legal Structure

The very first step is getting your business legally registered. Our team assists you in choosing the right structure—whether it’s a Private Limited Company, LLP, or any other form—based on your goals, scale, and compliance needs. We take care of everything, from MCA registration, PAN, TAN, to GST, ensuring your entity is legally recognized and ready for formal operations.

End-to-End Regulatory Approvals

From there, we guide you through the entire approval process—starting with Consent to Establish (CTE) and Consent to Operate (CTO) from the State Pollution Control Board. We don’t just give you a checklist—we actively prepare and submit the applications, draft the required reports, layout plans, compliance charts, and even handle follow-ups with the pollution control department.

Whether you're applying for licenses under Solid Waste Rules, Plastic Waste Management, Biomedical Waste, E-Waste, or Hazardous Waste, our team ensures you submit the correct application under the right rule—at the right time. We minimize the risk of rejection or delay by proactively managing the fine print.

Pollution NOC and Licensing Support Across India

We specialize in providing Pollution NOC consultancy services PAN-India, and our experience across states like Delhi, Uttar Pradesh, Maharashtra, Haryana, and Karnataka means we understand state-specific procedures and documentation formats. Each state has a slightly different system—and we know how to get through it.

For instance, if you're trying to set up a recycling unit in Maharashtra, or a waste-to-energy plant in UP, or a composting facility in Karnataka—our experts are equipped with the localized experience needed to get your project moving faster.

Expert Drafting & Documentation

Legal documentation is a big part of this business. We help you draft:

- Lease agreements for plant locations

- MoUs with waste suppliers

- Vendor contracts

- SOPs for waste handling and compliance

- EPR fulfillment agreements

- Environmental Management Plans (EMP)

We also prepare project reports and legal annexures needed for applying under CPCB or MoEFCC portals.

Compliance Monitoring & Renewal Management

Regulatory compliance doesn’t stop once you get your license. Waste management is a continuouscompliance industry—yearly reports, license renewals, inspections, EPR filings—it all comes around quickly.

At Lawfinity, we maintain a renewal calendar for your licenses, monitor regulatory deadlines, and even assist with periodic filings like CPCB’s annual returns or SPCB’s compliance audits. This ensures that your licenses never lapse and you avoid penalties or interruptions in your work.

One-Stop Waste Compliance Partner

We don’t believe in just “consulting” and walking away. Lawfinity becomes your one-stop compliance backbone—working quietly in the background while you focus on your business operations, logistics, and client building. From first-time founders to legacy infrastructure players—we’ve helped businesses of all sizes build and scale in the waste industry with confidence and peace of mind.

Ready to get started with your waste management business—legally, quickly, and efficiently?

Visit www.lawfinity.in or reach out to our experts. Let's build something sustainable—together. Lawfinity India – Your Legal Partner in Clean Business.

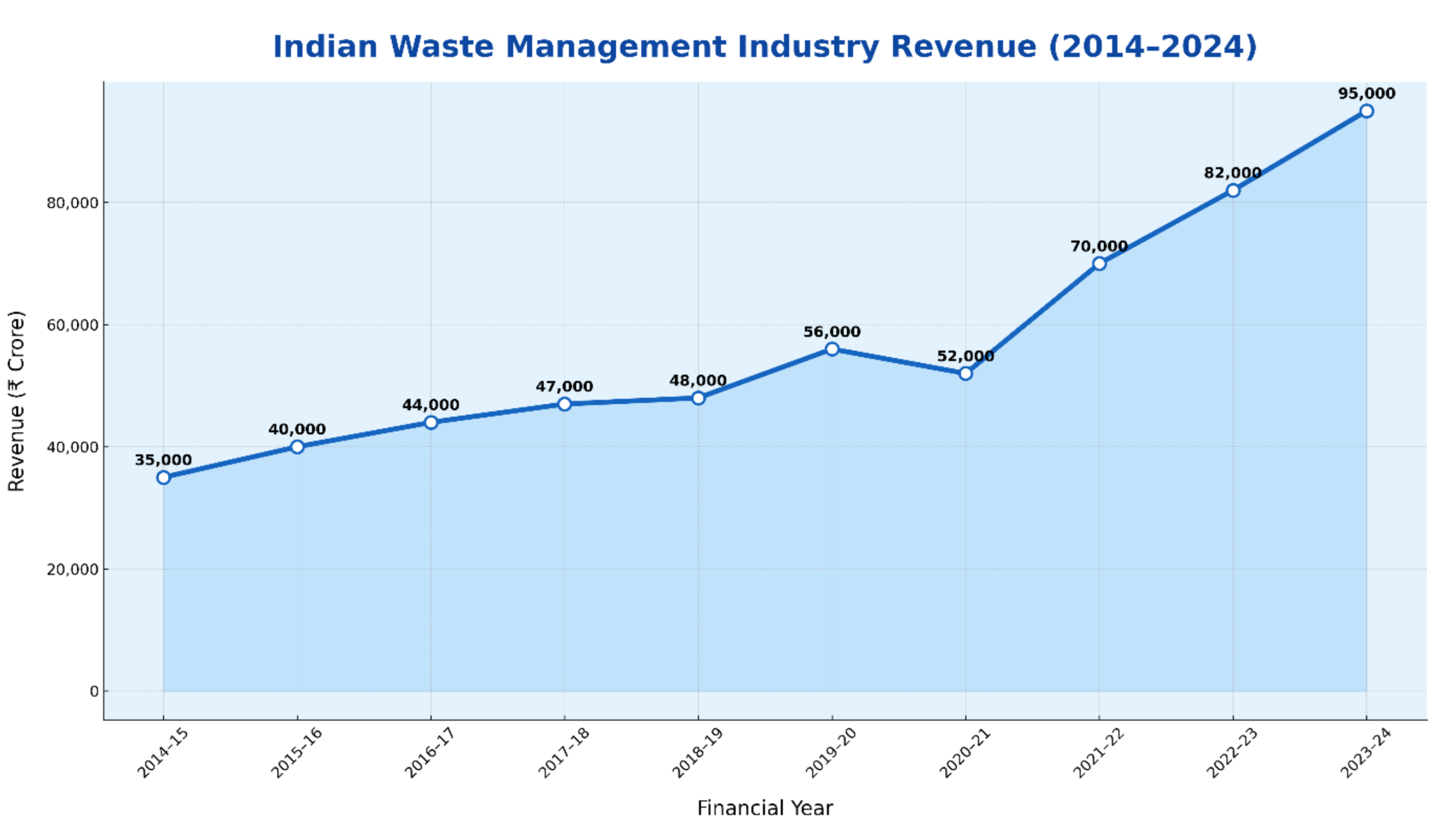

INDIAN WASTE MANAGEMENT INDUSTRY REVENUE (2014–2024)

Source: Grand View Research (2023), Market Research Future (MRFR, 2024), Mordor Intelligence (2025) and Ken Research

Revenue Growth of the Indian Waste Management Industry (FY 2014–15 to FY 2023–24)

This graph showcases the estimated revenue growth of the Indian Waste Management Industry over the last ten financial years, from FY 2014–15 to FY 2023–24.

The industry started at around ₹35,000 crore in FY 2014–15 and gradually expanded to ₹56,000 crore by 2019–20, driven by urban reforms and municipal waste initiatives.

A minor dip in FY 2020–21 due to the pandemic brought revenues down to ₹52,000 crore.

The sector rebounded strongly post-COVID, reaching ₹95,000 crore in FY 2023–24, marking the highest-ever turnover in the history of organized waste management in India.

AUTHOR’S OPINION: A DECADE OF DECENTRALIZATION, DISRUPTION & REVIVAL

The Past: From Informal Cleanup to National Priority

Ten years ago, India’s waste management sector was largely decentralized, informal, and poorly funded. Municipal bodies lacked the infrastructure and manpower to handle growing urban waste, and private participation was limited to low-cost collection contracts. While solid waste generation increased year-on-year, the handling capacity failed to keep pace.

The introduction of the Swachh Bharat Mission in 2014 brought much-needed political and financial focus to the problem. Cities began investing in door-to-door collection, waste segregation, and basic processing infrastructure. With government grants, World Bank support, and private innovation in composting and waste-to-energy (WTE) systems, the market expanded steadily. By 2019–20, the industry crossed ₹56,000 crore, reflecting improved institutional frameworks and rising awareness about sanitation and environmental health.

However, the sector remained heavily reliant on manual scavenging, untrained labour, and single-use plastics, with minimal regulation of hazardous or electronic waste.

The Present: Technology, ESG Mandates & Public-Private Partnerships

The pandemic-induced disruption in 2020 temporarily slowed operations, especially in commercial zones and industrial clusters. But the crisis also emphasized the importance of sanitation, biomedical waste handling, and resilient supply chains in waste logistics.

In the post-COVID era, the industry saw an aggressive policy shift. The E-Waste (Management) Rules, Plastic Waste Management Rules, and Extended Producer Responsibility (EPR) mandates began reshaping industry compliance. Urban Local Bodies (ULBs) implemented door-to-door waste audits, digitized waste tracking, and improved collection efficiencies.

Private players, ESG-conscious investors, and sustainability startups began entering the space — bringing AI-enabled sorting technologies, IoT-based waste bins, and decentralized bio-CNG plants into mainstream usage. As a result, revenues shot up to ₹95,000 crore by FY 2023–24, almost tripling from the 2014 levels.

Today, India’s waste sector is no longer just about garbage disposal — it’s about resource recovery, climate strategy, and circular economy execution.

The Future: Formalization, Innovation & a Circular Economy

The future of waste management in India is deeply tied to smart city infrastructure, environmental justice, and circular economy integration. With the government pushing for zero landfill cities, plastic credits, and green building mandates, the sector is projected to grow at CAGR of 7–9%, easily surpassing ₹1.5 lakh crore by 2030.

Emerging growth areas include:

- Waste-to-energy plants, especially in Tier 1 and Tier 2 cities

- Battery and EV waste handling infrastructure

- Chemical recycling and recovery of rare earths from e-waste

- Digitized traceability platforms using blockchain and AI

- Formalization of the informal kabadi (scrap) network under state guidelines

But challenges remain — lack of land for new facilities, opposition to incinerators, under-capacity in hazardous waste plants, and the slow pace of local clearances. States like Maharashtra, Tamil Nadu, and Karnataka are leading the way in structured waste zones, but others still struggle with enforcement and manpower.

CONCLUSION: AN INDUSTRY ONCE IGNORED, NOW INDISPENSABLE

From my perspective, the Indian waste management industry has undergone a silent revolution. What began as a neglected municipal function has evolved into a dynamic sector involving urban planning, energy generation, and environmental stewardship.

The journey from “cleaning the streets” to “powering the economy with waste” is already underway.

With sustained investment, regulatory clarity, and public-private innovation, India’s waste industry is not just catching up with global benchmarks — it’s positioning itself as a model for sustainable development in the Global South.

Frequently Asked Questions

Because every great business starts with the right answers.

Private Limited Company is ideal if you plan to scale and attract funding. LLP is better for smaller, low-risk operations. Register your business with the Ministry of Corporate Affairs and consider factors like liability, compliance needs, and investor interest.

You need Consent to Establish (CTE) and Consent to Operate (CTO) from your State Pollution Control Board. Additionally, obtain a trade or factory license from your local municipal authority before starting operations.

Yes, if your project is large-scale. Environmental Clearance involves an Environmental Impact Assessment (EIA), public consultation, and approval from an expert appraisal committee. Smaller projects may be exempt but should check the EIA Notification thresholds.

If you handle solid, plastic, e-waste, hazardous, or biomedical waste, you must obtain the relevant authorization from your State Pollution Control Board, depending on the type of waste processed, stored, or transported.

Apply to your local municipal authority with a detailed waste handling and processing plan. Authorization is granted based on compliance with Solid Waste Management Rules and proof of proper waste segregation, disposal, and recordkeeping.

Yes. If you are a producer, importer, or brand owner of plastic or electronic products, you must register with the Central Pollution Control Board and meet EPR targets by working with authorized recyclers and maintaining proper documentation of waste collection and processing.

It usually takes 30–60 days to get Consent to Establish or Consent to Operate. Larger projects involving Environmental Clearance can take longer due to site inspections, EIA processes, and public consultations.

Penalties can include fines up to ₹50,000, suspension of your operations, or even prosecution. Authorities may inspect your facility, and failure to obtain required approvals can result in business shutdowns or legal action.

Yes. Various central and state government schemes offer loans, subsidies, or incentives for waste-to-energy, composting, recycling, and other sustainable practices under missions like Swachh Bharat and the Ministry of New and Renewable Energy programs.